The S&P 500 and the Nasdaq surged to start the last week of 2021, with the benchmark index posting its 69th record close of the year on Monday. Investors poured back into stocks last week after it became clear the U.S. wasn’t about to head into another round of lockdowns.

Wall Street has taken its foot off the gas since then, seemingly content with the Santa Clause rally as trading volumes dry up in favor of holiday vacations. Traders have every right to be pleased with how the year ended, especially when taking a step back to appreciate the entire 2021 rally.

The bulls bought every dip they could and rarely let any major index sink too far below its 50-day moving average for long. It will be hard to live up to the recent market showings in 2022, and there are plenty of unknowns, coupled with rising prices, covid, tapering, and interest rate hikes—which the Fed projected it will start to make in the back half of the year.

Still, the outlook for S&P 500 earnings and margins are resilient and interest rates should remain historically low for the near future, unless inflation spikes way out of control. And it’s worth noting that Wall Street has already recalibrated countless overheated growth stocks, with many names trading near 52-week lows heading into 2022.

This helps show that investors have been more reasonable despite the broader market exuberance, with the strength of mega-cap tech like Apple papering over what was a rough year for many one-time covid high-flyers.

Given this backdrop, investors might want to hunt for new names for their portfolios as we head into 2022. Here are a few ‘Strong Buy’ stocks worth considering…

Planet Fitness, Inc. (PLNT)

Planet Fitness is a U.S. fitness chain powerhouse that operates a rapidly growing and successful franchise model. The company currently has over 15 million members and roughly 2,200 stores across the entire country. Planet Fitness carved out a popular niche in the highly competitive gym industry, through its Judgement Free Zone tagline an attractive and enticing pricing model, with monthly fees starting at $10.

Planet Fitness sales climbed at strong double-digit clips after its 2015 IPO until covid destroyed its business nearly overnight. PLNT’s 2020 sales fell 40% to $407 million. Luckily, people have raced back to gyms as the pandemic slowly fades. Planet Fitness topped our Q3 estimates in early November, crushing our adjusted EPS estimate by 47%. The company also provided an upbeat view, which helps it land a Zacks Rank #1 (Strong Buy) right now.

Zacks estimates call for its FY21 revenue to soar 42% to $577 million, with its adjusted earnings set to skyrocket from $0.04 a share to $0.79 a share. Better still, Planet Fitness’ fiscal 2022 EPS is expected to surge another 106% higher to $1.63 a share on the back of 34% higher sales that would see it pull in $771 million to easily blow away its pre-pandemic total of $689 million.

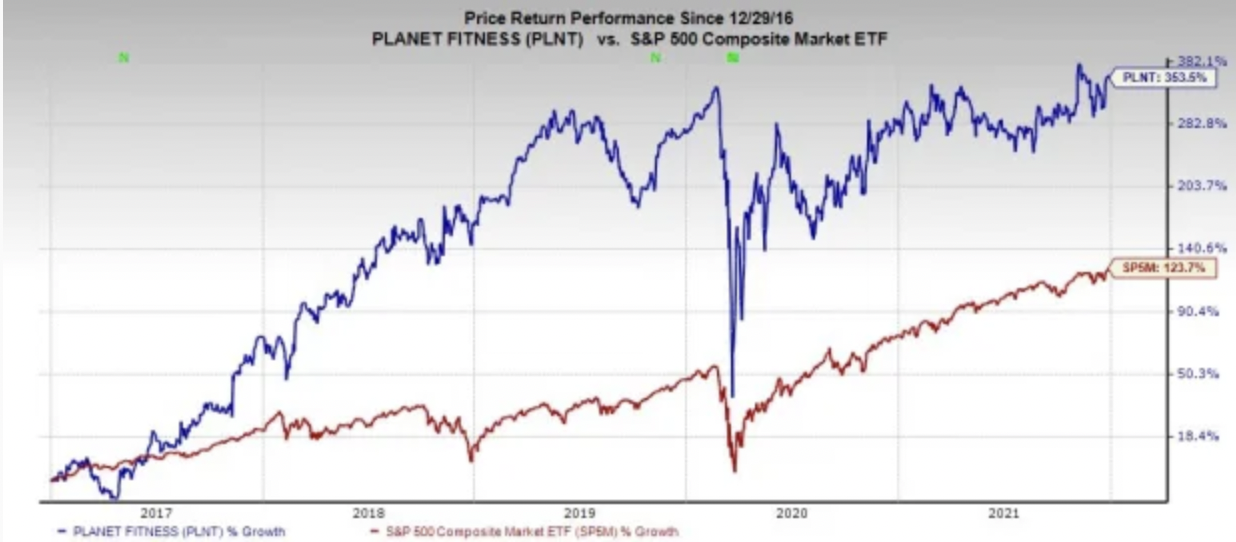

Planet Fitness shares have climbed 350% in the last five years to blow away the S&P 500 and destroy its industry. PLNT cooled off more recently, but it still jumped 17% in 2021, which included a 16% pop in the last three months. Wall Street also shrugged off Omicron fears as customers continue to head to gyms.

At $90.86 per share, Planet Fitness trades about 9% below its November peaks and 12% under its current Zacks consensus price target. Meanwhile, seven of the 11 brokerage recommendations Zacks has are “Strong Buys,” with one more “Buy” and nothing below a “Hold.”

PLNT’s Leisure and Recreation Services space is in the top 25% of over 250 Zacks industries. Planet Fitness executives are set on continued expansion, and the downfall of Peloton stock in 2021 suggests Wall Street is prepared to prolong the economic reopening trade.

Sonos, Inc. (SONO)

Sonos is a speaker company that competes against Bose, Apple, and others in the higher-end home audio market. Sonos sells a range of sleek, connected speakers, subwoofers, soundbars for TVs, and more. Its baseline speakers start under $200 and packages can cost over $2,000. The company in the spring officially entered the popular portable smart speaker space with its new $179 mass-market Roam speaker.

The company’s non-speaker business includes a $7.99 a month ad-free streaming tier of its music service to help it compete against Spotify. Sonos is set to continue to benefit from the larger shift to modern, connected devices. With this in mind, Sonos revenue climbed 11% in fiscal 2019 and 5% last year. It then posted blowout FY21 results (period ended on October 2) with sales up 30% and its adjusted earnings up from $0.67 per share to $1.77.

Sonos has built up a loyal customer base, full of repeat buyers. The firm’s total households climbed 15% last year to 12.6 million and its products per household increased to three. Plus, Sonos executives raised their 2022 guidance in the face of global supply chain bottlenecks. And they said its “powerful momentum” has it “ahead of schedule” in terms of reaching its fiscal 2024 financial targets.

Sonos is “confident in” its “ability to deliver an approximately 13% revenue CAGR, 45% to 47% gross margin, and 15% to 18% adjusted EBITDA margin through fiscal 2024.” Current Zacks estimates call for Sonos revenue to climb 14% this year and over 12% in FY23 to $2.2 billion. Meanwhile, its adjusted EPS are projected to slip compared to its hard-to-compete-against FY21, before bouncing back in FY23.

Luckily, its overall FY22 and FY23 consensus EPS estimates have climbed since its release to help it capture a Zacks Rank #1 (Strong Buy) right now. And it has now crushed our EPS estimates by an average of 178% in the trailing four quarters. Investors should also be excited to hear that Sonos executives announced a new stock buyback program in November.

SONO, which went public in 2018, shares have surged 94% over the past two years. Luckily for investors who missed out on this ride, the stock only popped 25% in 2021. Sonos closed regular trading Wednesday 35% beneath its April records at $29.40 per share. And its Zacks consensus price target represents 60% upside to its current levels.

Sonos does trade below both its 50-day and 200-day moving averages at the moment. Yet, there is plenty of runway considering its growth outlook and its recalibrated valuation. SONO is trading right near its year-long lows at 21.8X forward 12-month earnings. This marks a slight discount to the S&P 500 and not too much of a premium compared to its industry, which it outperformed rather easily over the past two years.