The EV leader is gearing up for another stock split, and that could trigger another bullish surge among retail investors.

A regulatory filing made by Tesla (TSLA -12.18%) at the end of March revealed that the electric vehicle (EV) leader plans to carry out another stock split. Exact details about the plan were scarce, but the filing did indicate that the move would pave the way for CEO Elon Musk’s company to begin paying a dividend.

Tesla last split its stock in August 2020, carrying out a 5-for-1 share exchange. From the day of the move’s announcement to the day it was completed, Tesla’s stock price increased by 80%. Should investors pounce on this industry innovator’s shares before it carries out its next stock split?

Tesla is posting impressive growth

Tesla published its first-quarter earnings results earlier this month, and the business delivered another period of impressive growth. Automotive revenue surged by roughly 87% year over year to $16.86 billion, and its net cash flow from operating activities surged by 143% to nearly $4 billion. The EV leader produced 305,407 vehicles in the quarter and delivered 310,048, performance that represented year-over-year jumps of roughly 69% and 68%, respectively.

Demand for Tesla’s vehicles has been strong, and it’s posting margins that are fantastic for its industry. Tesla’s operating margin leads the pack among major automakers, and the company is poised to expand in high-margin categories including battery technology and self-driving software licensing. That supports the idea that Tesla should trade at significantly higher price-to-sales and price-to-earnings multiples than the auto industry stalwarts. However, just how much of a premium it deserves is the question that investors will have to weigh.

Consider valuation

While the EV market is growing at a rapid clip and creating high-margin business opportunities, it’s worth noting that the automotive industry has historically been very competitive and relatively low margin.

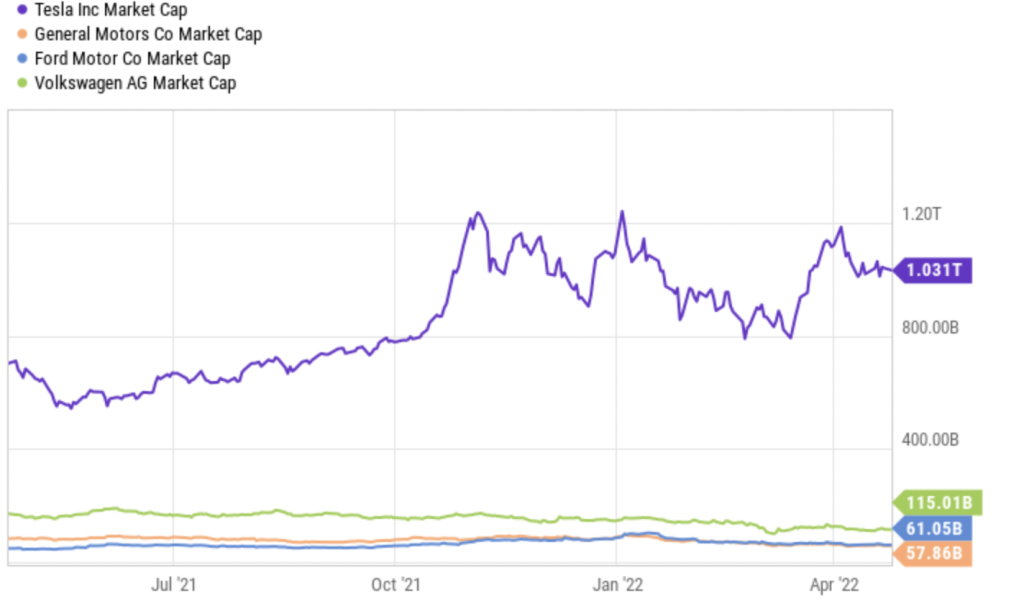

Tesla is currently valued at roughly 4.4 times the combined market capitalizations of General Motors, Ford, and Volkswagen. Tesla has been posting sales and earnings growth that dramatically exceeds that of its main industry rivals, but on the top and bottom lines, it still trails significantly behind each of these companies.

If you combine the performances of GM, Ford, and Volkswagen over the trailing 12 months, the cohort generated $559.37 billion in revenue and net income of $46.16 billion. Meanwhile, Tesla generated sales of $53.82 billion and net income of $5.52 billion. Musk’s company is growing quickly while also generating better margins, but investors will have to determine whether they think it’s worth the valuation premium given that the EV market and its adjacent industries are on track to become increasingly competitive.

Approach Tesla with your personal risk tolerance in mind

While Tesla undeniably holds a leadership position in the EV space, its stock remains a relatively high-risk investment. If you have an above-average tolerance for risk, and think that the company will go on to deliver more strong performances with its electric vehicles, battery technologies, and autonomous vehicle software, it could be a worthwhile long-term investment. The company has certainly done a great job of proving doubters wrong thus far.

Approach Tesla with your personal risk tolerance in mind

While Tesla undeniably holds a leadership position in the EV space, its stock remains a relatively high-risk investment. If you have an above-average tolerance for risk, and think that the company will go on to deliver more strong performances with its electric vehicles, battery technologies, and autonomous vehicle software, it could be a worthwhile long-term investment. The company has certainly done a great job of proving doubters wrong thus far.