One REIT prepared ahead of time; the other’s basic business model suggests it can handle a recessionary hit.

A recession is basically an economic downturn, often described as two quarters of negative gross domestic product, though that isn’t the technical definition. Recessions happen with a fair amount of regularity, and they hurt, even though they are just a normal part of the economic landscape.

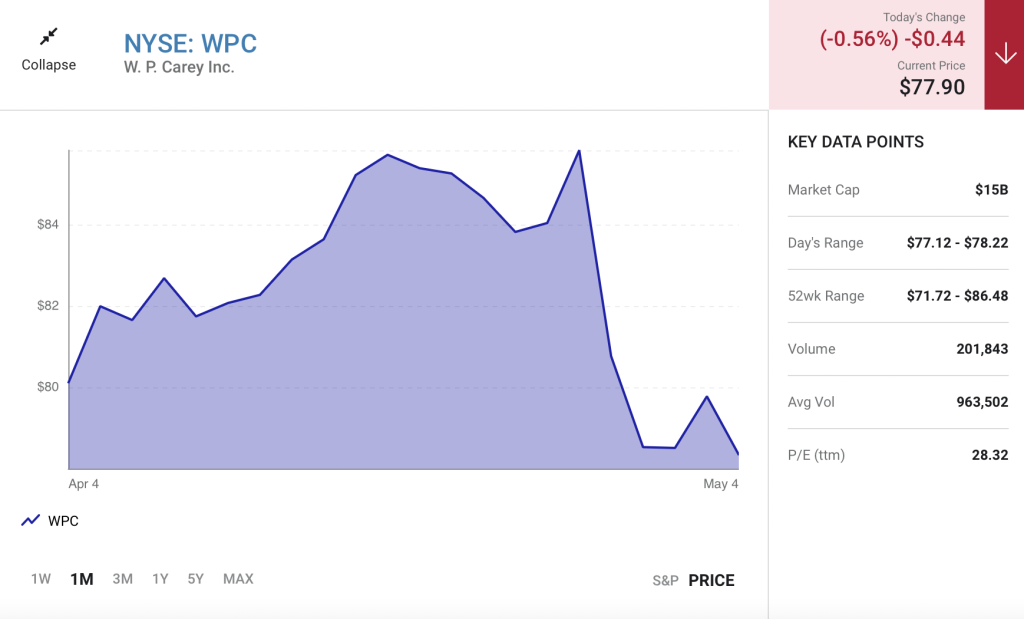

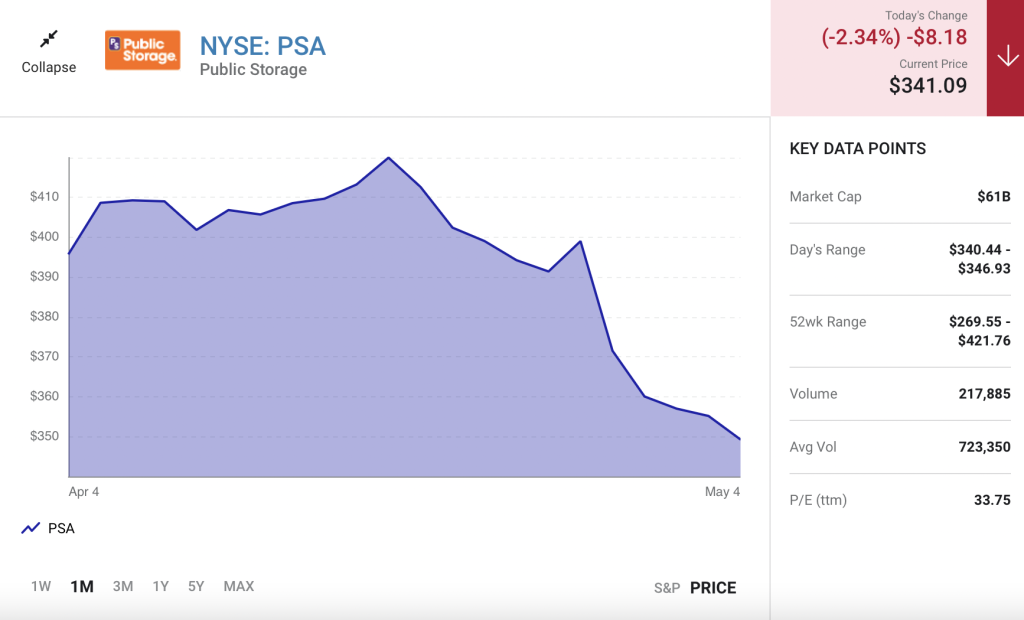

You can, however, provide yourself with some protection if you think ahead. Two real estate investment trusts (REITs) you may want to consider if you are worried about a recession today are W.P. Carey (WPC -0.56%) and Public Storage (PSA -2.34%).

1. Ready in advance

W.P. Carey is a net lease REIT, meaning it owns assets for which its lessees are responsible for most of a property’s operating costs. Spread across a large enough portfolio, it’s a fairly low-risk investment approach. W.P. Carey owns over 1,300 properties. It also spreads its bets, with assets across the industrial, warehouse, office, retail, and self-storage sectors.

And it offers geographic diversification, too, with assets in both the United States and abroad (mostly Europe). Diversification is good for your portfolio, and it has been good for W.P. Carey’s business, noting that the REIT has increased its dividend annually since its 1998 initial public offering (IPO).

But there are two other features here that are relevant today. First, the average lease term for W.P. Carey’s portfolio is 10.8 years. That means it has tenants locked in for over a decade, which should be more than enough time for the economy to recover from the next downdraft. That is, basically, the point of inking such long-term deals, as they provide consistency to the REIT’s results.

Then there’s the fact that about 60% of W.P. Carey’s leases have rent escalators tied to inflation. Yes, inflation is raging today, but the REIT’s rent roll will adjust to that hit. The Federal Reserve is increasing interest rates to fight inflation, which could trigger the next economic downturn, but W.P. Carey will actually enter that business weak patch in a stronger position than peers that don’t have inflation-linked lease hikes built into their portfolios.

That will give W.P. Carey more wiggle room to maneuver and, perhaps, even expand its portfolio as businesses look to raise cash by doing sale/leaseback transactions. That’s actually a common theme here, noting it was early to invest in industrial assets during the pandemic. And you can collect a generous 5.2% dividend yield while you wait for the economy to sort itself out.

2. A place for your stuff

One thing that the economic roller coaster doesn’t usually change about humans is the ever-expanding collection of belongings we have. Public Storage’s bread and butter is offering a safe and secure place for our piles of stuff outside of our primary living space. It’s huge, with nearly 2,500 facilities spread across the United States. There are a couple of reasons you should expect its business to weather a recession in stride.

First, the cost of a storage unit is relatively modest in the grand scheme of things. So, it isn’t a huge financial burden. Second, it is a hassle to move things in storage once they are there just to save a little cash. Third, if you are forced out of your residence because of the downturn, a storage unit is a good compromise location for a person’s belongings until they get back on their feet.

That’s not to suggest that Public Storage won’t be impacted by a downturn, given that its leases are basically month to month. Only that, given the alternatives, during weak economic periods, a Public Storage unit could easily be the best option available for many customers facing hardships. And those not feeling the economic strain, well, they are unlikely to move their stuff anyway.

Public Storage offers a 2.1% dividend yield, which isn’t huge, but the payment was maintained right through each of the last three recessions. Economic downturns aren’t pretty, and Public Storage’s stock could easily get caught up in a bear market on Wall Street. But its business will likely remain very robust despite all that short-term noise. If you can focus on the long term instead of the noise, Public Storage’s resilient business model is worth a closer look as the next recession nears.

It’s coming, like it or not

You can be 100% confident that a recession is coming, given that they are a normal part of the economic cycle. When, well, that’s another story since nobody has a crystal ball. That said, W.P. Carey looks poised to survive and, perhaps, even thrive up to and through the next economic downturn. Public Storage, meanwhile, has a business model that is tailor-fit to help people muddle through tough times as they look to keep their stuff safe and sound. Both are worth a look today as fear of the next downturn continues to rise.