These stocks provide reliable passive income with high-yielding dividends.

Passive income is perhaps the most attractive benefit a stock can offer for a retiree. When that’s the main goal, the higher the dividend yields, the better. But that comes with a caveat: only as long as the stock is supported by an established, reliable company.

There are massively high dividends out there that come with risk, such as Annaly Capital Management, a mortgage real estate investment trust (mREIT) that yields more than 13%. Since it deals with mortgages, it’s highly susceptible to interest rate changes. That makes it potentially inconsistent, which might suit a younger investor but not work as well for a retiree dependent on consistent income.

In addition, the best portfolio is a diversified one, so you’d want to spread your confidence among different industries and not only invest in REITs, for example. With those factors in mind, I recommend these 3 dividend stocks below.

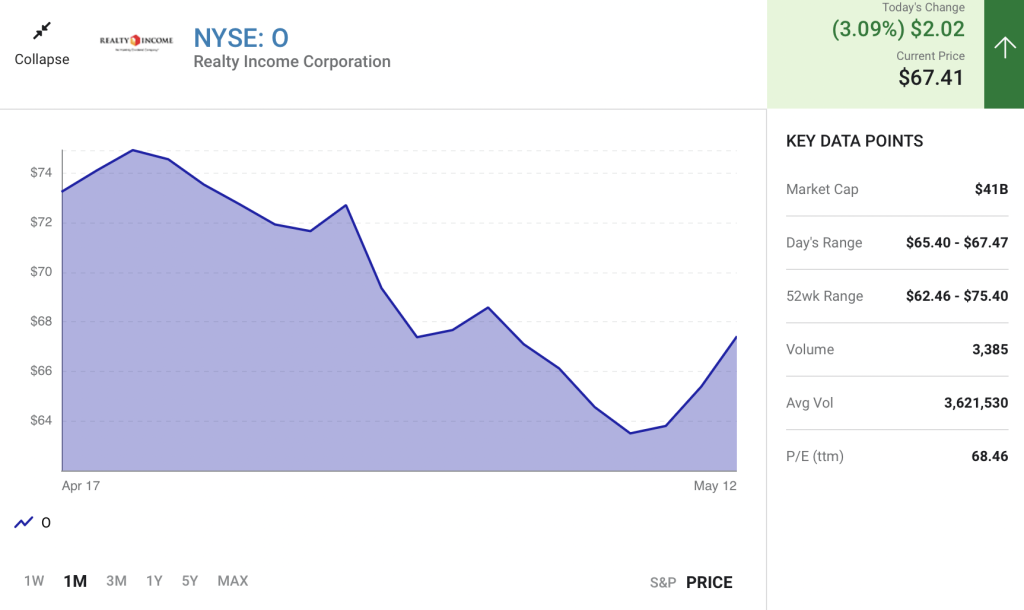

1. Realty Income: A top REIT

Realty Income is a growing, high-yielding REIT that’s about as dependable as REITs come. A REIT owns and rents properties and is structured in a way that it needs to pay out 90% of income as dividends, which is why REITs are typically sought-after passive income streams.

There are a few reasons why Realty Income is a top REIT. One is the sheer amount of properties it operates — more than 11,000 (after acquiring fellow REIT VEREIT last year), making it one of the largest REITs in the world. It also typically works with large, secure chain stores in essential industries.

Those solid tenants proved their worth at the beginning of the pandemic when they were allowed to stay open and paid their rent while nonessential stores had to close, with some of them delaying rent payments or closing up shop altogether. Its top five tenants (by percentage of portfolio) are Walgreens, 7-Eleven, Dollar General, Dollar Tree, and FedEx.

However, Realty Income works with over 1,000 tenants in 70 industries. It maintains a nearly 99% occupancy rate, and the average weighted remaining lease for its tenants is almost nine years, putting in a strong long-term position.

In the first quarter, net income per share improved from $0.26 to $0.34, and adjusted funds from operations, a standard metric for evaluating REIT performance, increased 47% year over year to $1.02. As for its dividend, it pays a monthly dividend and has done so for 621 months consecutively, including 98 quarterly increases.

Its dividend yields 4.5%, and retirees don’t need to look any further than this for a stable, consistent dividend.

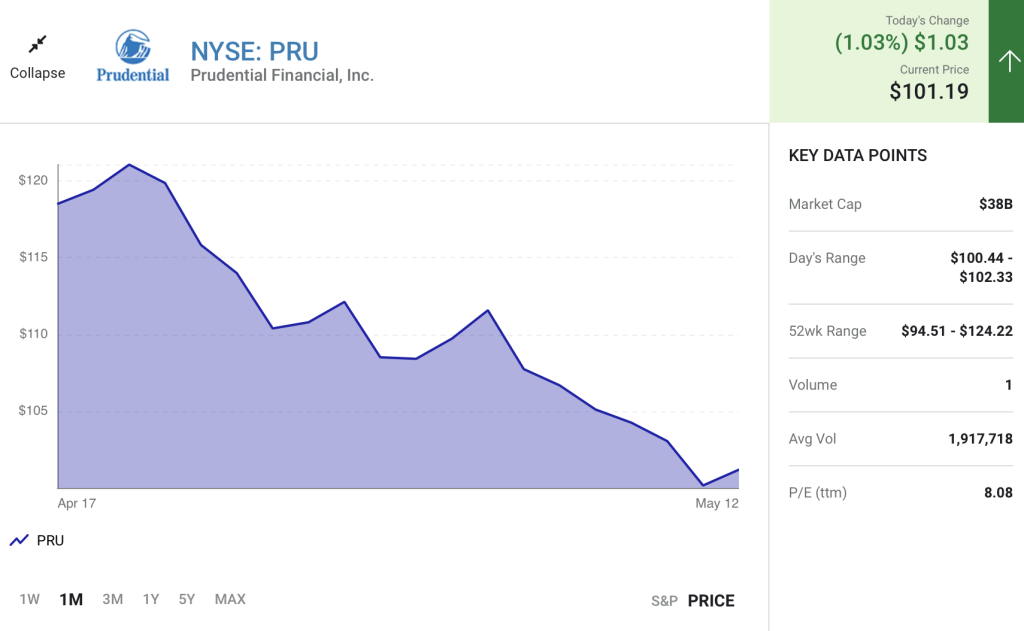

2. Prudential Financial: A financial powerhouse

Prudential is a financial services company that offers insurance policies, retirement plans, and general investing services for individuals. It’s one of the oldest companies in the U.S., going back to 1875, and it prides itself on its stability — so much so that its logo is the Rock of Gibraltar, although many people just recognize it as the Prudential rock. The company has more than $1.6 trillion in assets under management, with its largest presence in the U.S., although it operates globally.

As a financial services company, Prudential is highly susceptible to interest rate changes. That came through clearly in the first quarter, when it posted a loss of $31 million, after net income of more than $2 billion last year. However, this cash-rich company keeps a steady load on its balance sheet, with more than $16 billion at the end of the first quarter, and nearly $520 billion in equity and bonds.

This isn’t a growth company, and investors shouldn’t expect high gains from its stock. That’s why it’s incredibly cheap, trading at less than 6 times trailing 12-month earnings. What they can expect is a super-reliable dividend that yields 4.6% at the current price, has been raised for the past 14 years, and should provide years of passive income.

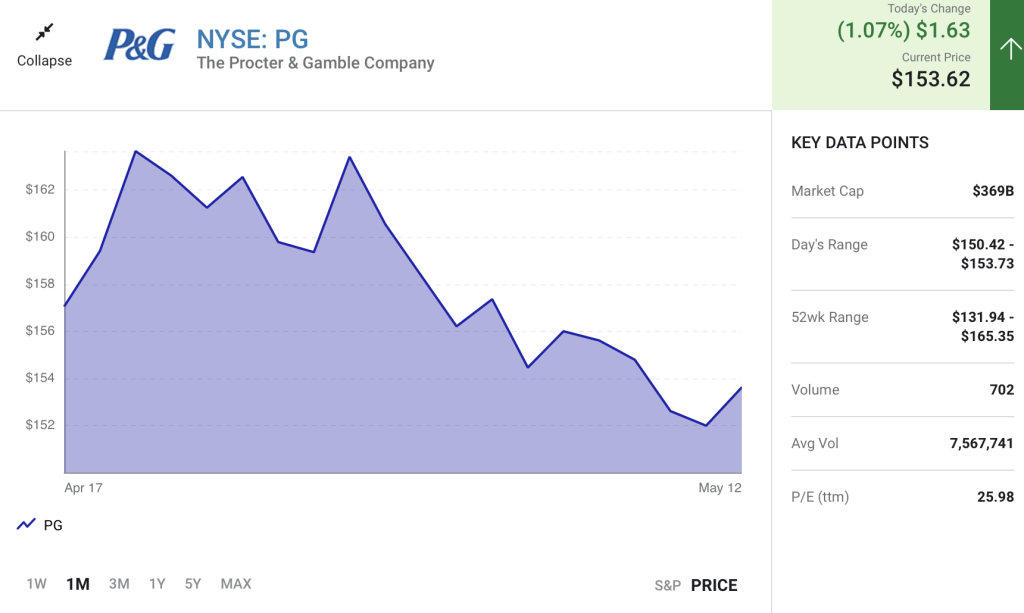

3. Procter & Gamble: All your household essentials

Procter & Gamble markets household products under many of your favorite brand names, such as Tide laundry detergent, Bounty paper towels, and Oral-B dental hygiene. It’s even older than Prudential — around since 1837. The company took in $79 billion in trailing 12-month sales, and fiscal third-quarter sales (ended March 31) increased 7% year over year. So while it’s an established essentials giant, it’s still managing to increase its presence and capture market share.

Like most companies, Procter & Gamble has had to deal with increased costs due to inflation and supply chain backups. However, it has been able to successfully navigate these difficulties with price increases and cost-cutting. One of the advantages of being a large, stable company is the ability to leverage relationships and processes to manage challenges, which is why Procter & Gamble is a compelling stock to own.

The other reason is the dividend. Not only is Procter & Gamble a Dividend King, but it has one of the longest streaks of annual dividend raises on the market at 66 years.

Its stock yields 2.3% at the current price, the lowest on this list. That has decreased as the price per share has risen.

Procter & Gamble’s dividend in the kind you can count on without thinking about, making it an excellent choice for retirees.