These mind-bogglingly cheap stocks are valued at 3 to 5 times Wall Street’s forecast earnings.

Regardless of whether you’re a new or tenured investor, it’s been a trying year. Since the curtains opened on 2022, the iconic Dow Jones Industrial Average, benchmark S&P 500, and growth-focused Nasdaq Composite, have respective fallen by 14%, 18%, and 27%. Losing more than a quarter of its value has pushed the Nasdaq firmly into a bear market.

Although a tumbling stock market can be scary and tug on investors’ emotions, big declines have always represented a buying opportunity. That’s because every crash, correction, and bear market in history has eventually been put into the rearview mirror by a bull market rally.

As the market has corrected lower, a number of stocks have begun to stand out as exceptional values. What follows are three deeply discounted stocks you’ll wish you bought on this Nasdaq bear market dip.

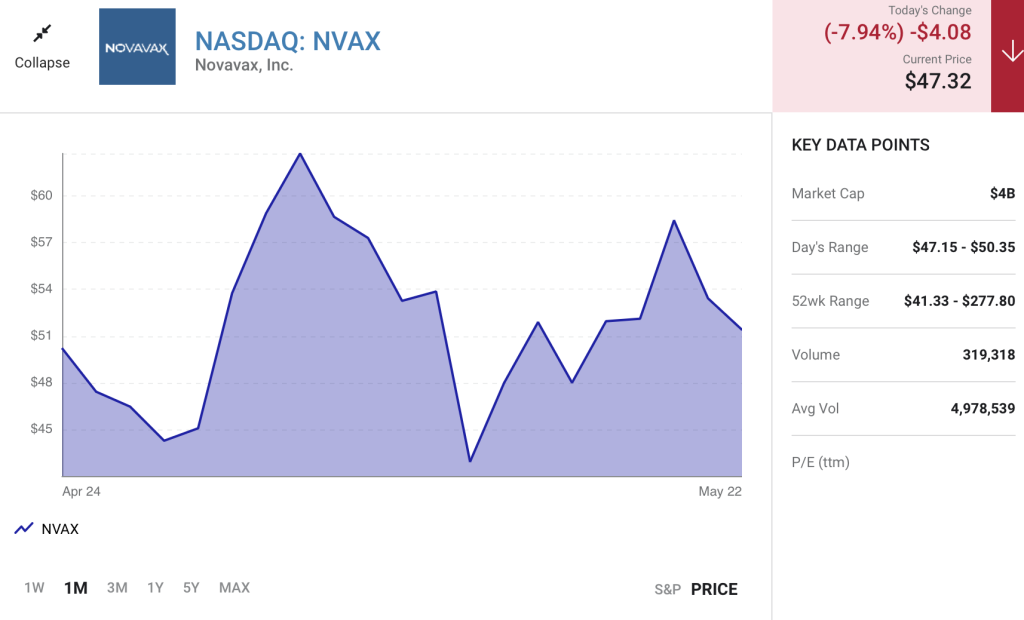

Novavax

The first incredibly inexpensive stock that investors will likely be kicking themselves over if they don’t purchase it on the dip is biotech company Novavax (NVAX -7.94%). Since hitting its pandemic high of $331.68, shares have retraced more than 80%.

Novavax’s claim to fame is the company’s COVID-19 vaccine, NVX-CoV2373. The company has run three pivotal, large-scale studies involving this lead vaccine, and each one was a success. Two trials in adults last year yielded respective vaccine efficacies (VEs) of 89.7% (U.K.) and 90.4% (U.S. and Mexico), while trial data released earlier this year on adolescents produced a VE of 80%. Novavax became only the third drugmaker to reach the elusive 90% VE threshold in COVID-19 clinical trials. This gives its vaccine a good shot at becoming a standard for initial inoculations overseas, and for booster shots in developed markets.

If you’re wondering why Novavax has lost so much of its value, the answer lies with management and negative investor sentiment since the beginning of the year. Management delayed filing for emergency-use authorization (EUA) in a number of developed markets until late last year, which limited its chance to nab the proverbial low-hanging fruit in high-margin developed markets. Vaccine production ramp-up has also been a bit slower than anticipated.

But the important thing to note here is that management is sticking by a full-year forecast of $4 billion to $5 billion in sales. This suggests any production issues should be resolved shortly.

Additionally, an EUA approval in the U.S. could be right around the corner. Since NVX-CoV2373 is a protein-based vaccine, as opposed to the messenger-RNA (mRNA) vaccines that dominate in the U.S. market, it could become a popular choice for initial inoculations and/or boosters for those who held out on getting a mRNA-based vaccine.

Investors have the opportunity to buy shares of Novavax for less than three times Wall Street’s forecast earnings for 2022. To further sweeten the pot, the company has $20 per share in cash, cash equivalents, and restricted cash, which accounts for 34% of its current market cap. Bargains simply don’t come more plain-as-day in the healthcare sector than this.

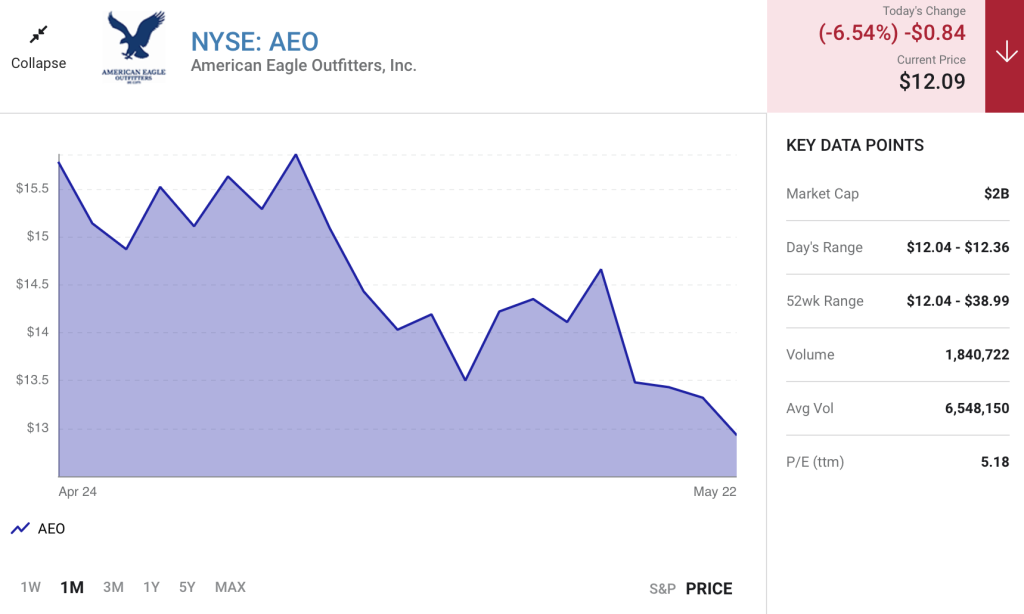

American Eagle Outfitters

Another deeply discounted stock you’ll wish you bought on the dip is specialty retailer American Eagle Outfitters (AEO -6.54%). Shares of American Eagle (AE) have retraced 66% since hitting an all-time high this past June.

There’s no question that American Eagle Outfitters — and virtually every retail stock for that matter — is facing a laundry list of headwinds. Historically high inflation has caused lower-income consumers to be more mindful of their spending. Meanwhile, global supply chain issues have coerced American Eagle to pay more to fly merchandise in. It’s probably a given that the company’s fiscal 2022 outlook points to some modest level of softening when the company reports its first-quarter results on May 26.

But even with outlook softening baked in, AE is a screaming bargain.

This is a company that finds itself perfectly positioned in the price column. Whereas Abercrombie & Fitch risks pricing teens and their parents out of purchases, and a chain like Aeropostale cheapens their brands with steep discounts, AE finds its niche right in the middle. It provides the brand-name apparel and accessories teens and young adults want, but without the arm-and-leg price tag.

American Eagle Outfitters also has a storied history of moving unwanted merchandise out of its stores quickly. Instead of getting into deep-discount cycles, AE’s operating results suggest it does a phenomenal job of selling full-price merchandise, which is a recipe for long-term margin expansion.

Investments in direct-to-consumer sales have paid dividends as well. At the end of fiscal 2021 (Jan. 29, 2022), store revenue rose 3% from pre-pandemic levels. Comparatively, digital sales were a whopping 46% higher than fiscal 2019.

But the biggest catalyst for AE just might be Aerie, its intimate apparel brand. Sales are up 72% since fiscal 2019, and the company is making every effort to open new Aerie locations in the years to come.

Sporting a 5.3% yield and forward-year price-to-earnings ratio of a little over 5, American Eagle Outfitters looks like a steal of a deal.

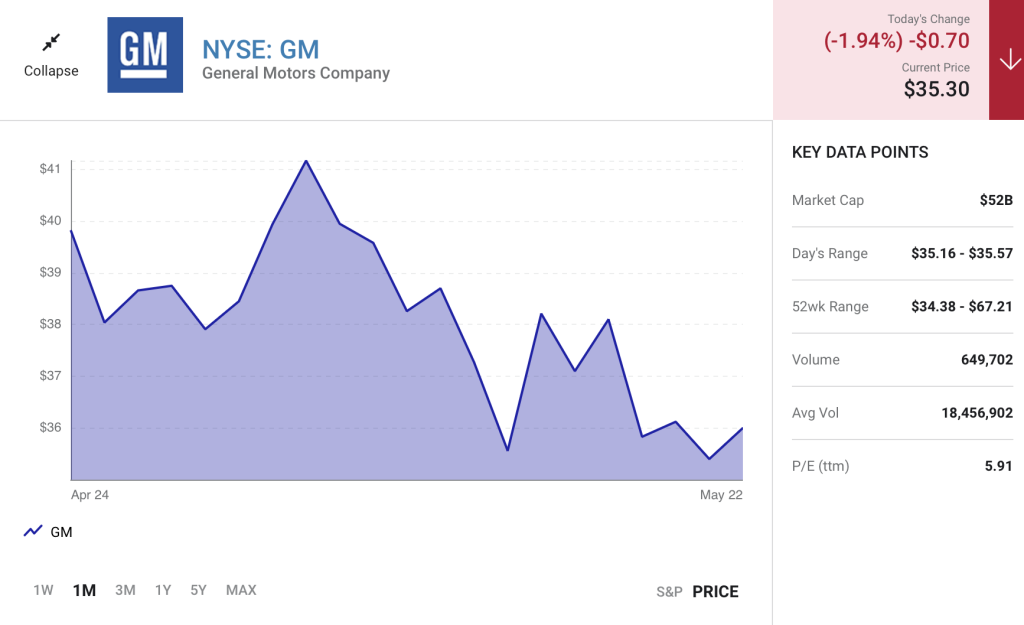

General Motors

The third deeply discounted stock you’ll wish you bought on the Nasdaq bear market dip is Detroit automaker General Motors (GM -1.94%).

As evidenced by the company’s 46% share price decline since early January, General Motors is hitting a number of speeds bumps that clearly have Wall Street concerned. Semiconductor chip shortages and supply chain constraints have curbed production, while COVID-19 lockdowns in select Chinese provinces have halted sales in key regions. Rising interest rates could also make it more difficult for consumers to afford new vehicles.

Yet in spite of these headwinds, GM stands out as a phenomenal stock to buy.

After more than a decade of waiting for General Motors to give investors and consumers a reason to be excited, we have the electric vehicle (EV) revolution. Pretty much all developed markets are aiming to curb their carbon footprints, with many encouraging EV use as a means to combat climate change. By 2030, EVs are expected to account for roughly half of all auto sales in the world’s top markets.

With the understanding that its long-awaited golden ticket has arrived, GM has boosted its spending on EVs, autonomous vehicles, and batteries, to $35 billion through 2025. CEO Mary Barra has laid out expectations that include:

- Launching 30 new EVs globally by the end of 2025.

- Opening two battery-focused facilities by the end of 2023.

- Totaling 400,000 EVs in aggregate North American production in 2022-2023.

- Reaching more than 1 million EVs produced annually in North America by 2025.

Something else to consider is that General Motors has sold 2.9 million vehicles in each of the past two years in China, the largest auto market in the world. It has the infrastructure, deep pockets, and existing presence to be a key player in China’s nascent EV industry.

Patient investors can scoop up shares of this bargain auto stock for a little over 5 times forecast earnings for this year. Even factoring in the low price-to-earnings ratios typically ascribed to auto stocks, this is downright cheap.