The streaming pioneer is falling out of favor with investors.

The pandemic certainly threw a curveball no executive team could’ve been prepared for. While some businesses struggled just to survive, many companies benefited from a major tailwind thanks to the health crisis. Shelter-in-place orders, as well as other restrictions on consumer mobility, created the perfect environment for Netflix (NFLX -2.13%) in particular. But things have taken a turn for the worse in a more normalized economy.

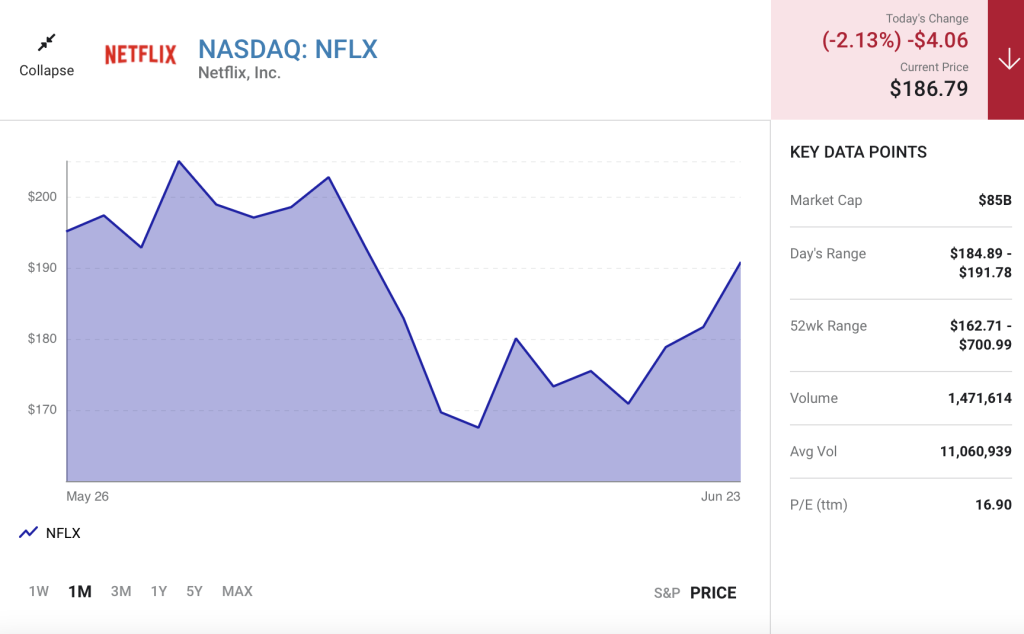

With shares in this top streaming stock down 70% in 2022, is now a good time to buy?

Netflix is facing a major slowdown

In the first quarter of this year, Netflix only grew revenue 9.8%, and it lost 200,000 subscribers. To be fair, shutting down its service in Russia lost it 700,000 subscribers, but it still managed to gain 500,000 elsewhere. Nonetheless, the situation spooked investors, punishing the stock. Adding fuel to the fire was management’s forecast that for Q2, Netflix would lose 2 million customers. For a business that has thrived over the past decade, especially during the depths of the pandemic, this was a rude awakening.

The leadership team, led by co-CEO Reed Hastings, mentioned competition from other streaming services as a factor to blame. Other macro-related factors, like “sluggish economic growth, increasing inflation, geopolitical events such as Russia’s invasion of Ukraine, and some continued disruption from COVID” are also creating a difficult operating environment for Netflix.

In order to reignite the company’s prospects and drive membership growth again, management will attempt to convert the 100 million or so households worldwide who share others’ passwords to actual paying customers. This consumer behavior wasn’t really discouraged before, as it brought the Netflix experience to more people.

But now, when growth is looking questionable, the company’s stricter stance could significantly boost sales — should it work. Netflix has 222 million subscribers today, so converting even a fraction of those password sharers to paying customers could provide a nice revenue bump in the short term. On the flip side, though, it could completely alienate some viewers and push them toward more affordable rival services.

Additionally, Netflix has publicly announced plans to introduce a cheaper, ad-supported tier to its offering in the near future. While this makes complete sense from a strategic perspective, what surprised investors and analysts is the change in tone from management’s constant rejection of this idea in the past to its recent reversal on the last earnings call. It’s still unclear what ad partners Netflix will use, but the move should help drive customer growth.

Netflix still has a massive global opportunity

Netflix is facing a tough time right now, but there’s a bigger-picture opportunity: The company might be close to reaching a saturation point here in the U.S., but globally, there’s still a ton of room for expansion left. Netflix’s 222 million members today don’t even come close to the 2020 peak of 1.1 billion cable-TV subscriptions, or the approximately 700 million broadband-enabled households around the world (excluding China, where Netflix isn’t offered) right now.

What’s more, Netflix is still the first mover in the streaming industry. This is a huge advantage, particularly as it relates to content spending. For the past decade, the business took advantage of cheap debt and little serious direct competition to continue attracting subscribers, increasing revenue, and reaching a level of scale that newer, smaller streaming businesses can’t match. Netflix can outspend rivals on content, to the tune of $17.5 billion in 2021, while still keeping it economical thanks to its massive subscriber base.

I wholeheartedly believe that introducing a cheaper, ad-based subscription tier will benefit the business. It will add new customers and boost revenue, which keeps Netflix’s flywheel of spending huge amounts on content going.

Furthermore, look at Netflix’s valuation. The business trades at a price-to-earnings (P/E) ratio of just 16.5 as of June 23, far lower than the historical 10-year average of 182. And this valuation is cheaper than the S&P 500‘s P/E of 20.3. Therefore, it’s not a stretch to say that Netflix is a value stock right now.

However, I think that Netflix needs to get back to posting solid subscriber and revenue growth before investors should consider buying the stock. Put this one on the watch list for now.