The oil company is again boosting its dividend while planning to return even more cash to shareholders.

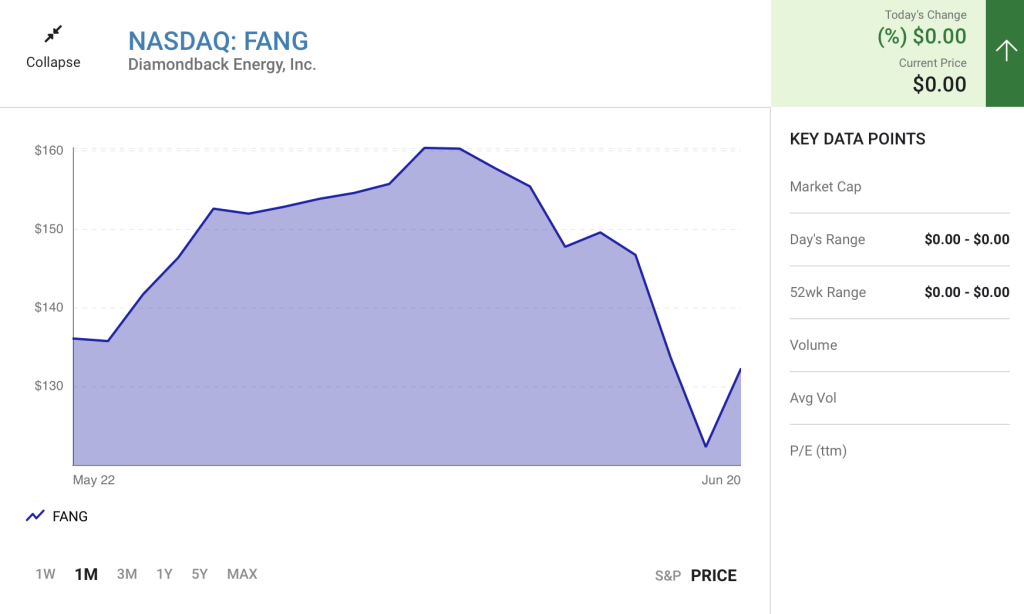

Diamondback Energy (FANG) is making a case for being one of the best dividend stocks in the oil patch. The oil producer announced plans to increase its base dividend once again, continuing the upward trend in the payout since initiating it in 2018. On top of that, Diamondback is increasing the amount of free cash flow it returns to investors each quarter. A meaningful portion of that return will likely come in the form of variable dividends in the future.

For the current quarter, those two dividends add up to an implied yield of 10% at the stock’s current price. That makes Diamondback Energy an attractive option for investors seeking a high-octane passive income stream.

A gusher of dividends

Diamondback Energy unveiled plans to increase its base quarterly dividend to $0.75 per share ($3 per share annualized). That’s 7.1% above its prior payout and pushes the base dividend yield to 2.5% at the current share price, well above the S&P 500‘s 1.6% dividend yield.

This increase is the latest in a string by the company. Diamondback boosted its payout by 17% in May, which followed a 20% raise in February. With this latest increase, Diamondback has grown its payout by an eye-popping 500% since initializing it in 2018.

However, the base dividend is only part of the company’s capital return plans. Diamondback also increased its capital return commitment to 75% of its free cash flow each quarter. That’s up from its prior commitment of 50% that it set last year. The company anticipates returning this money to investors through opportunistic share repurchases and variable dividends.

The company declared its first variable dividend last month. It paid out an incremental $2.45 per share on top of its $0.70 base payout. That brought the total dividend outlay to $3.05 per share for the first quarter, implying a 9.7% annualized yield at the time. The oil company also repurchased $7 million in stock during the first quarter, bringing its total cash return to $548 million, or about half its free cash flow.

The company plans to maintain that overall dividend level in the second quarter at $3.05 per share, including a higher base payment and slightly lower variable outlay. That implies a roughly 10% yield at the current share price. The company kept its total payment flat because it chose to repurchase more than $250 million of stock during the quarter. As a result, it should return over 50% of its free cash flow to shareholders in the second quarter.

Moving up the leaderboard

Diamondback Energy’s increased commitment to return at least 75% of its free cash flow to investors in future quarters is one of the highest in the oil patch.

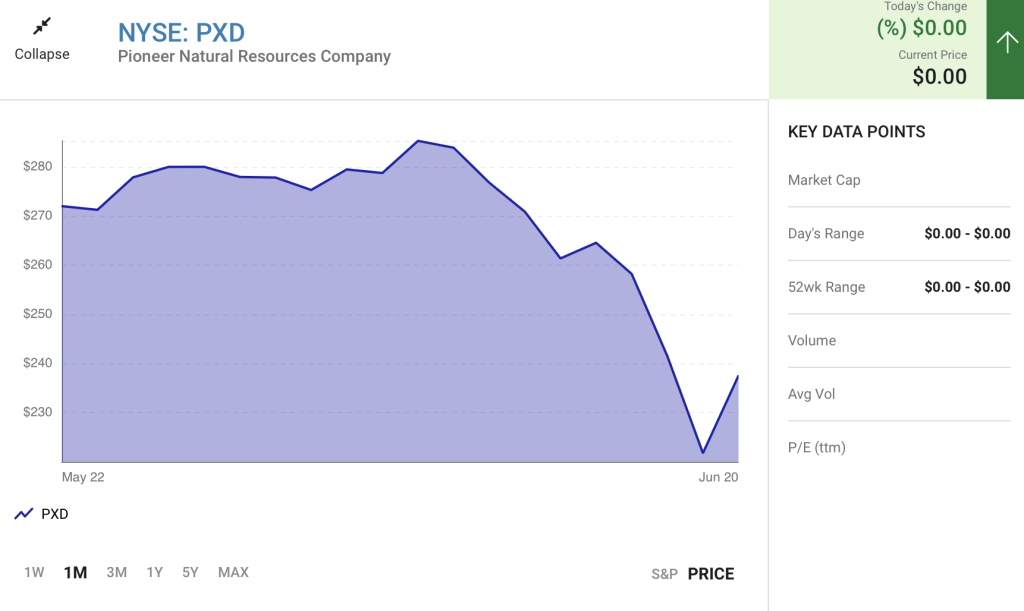

The current leader is Pioneer Natural Resources (PXD). The company pays out 75% of its free cash flow in dividends, consisting of a strong growing base payouts that it supplements with variable dividends. The company’s most-recent combined payout had an implied annualized yield of more than 11%. On top of that, Pioneer opportunistically repurchases shares, aiming to return at least 80% of its cash flow to shareholders through repurchases and dividends. The company delivered 88% of its free cash flow to shareholders in the first quarter.

Meanwhile, EOG Resources (EOG) recently set a target to return up to 60% of its annual free cash flow to shareholders. That capital return will come solely from dividends, including a fast-growing base payment and a steady stream of special dividends.

Another big-time oil dividend stock is Devon Energy (DVN). It set a target to pay a steadily rising base dividend and return up to 50% of its quarterly free cash flow to shareholders via variable dividends. Devon also has a share repurchase program and recently added more fuel to grow its dividends by making a needle-moving acquisition.

An increasingly attractive option for income seekers

Diamondback Energy has been an outstanding dividend stock since it initiated payments in 2018. The oil company has delivered high-octane growth, pushing its base payment to an attractive level relative to other dividend stocks. On top of that, it’s starting to pay massive variable dividends, fueled by its surging cash flows thanks to higher oil prices. With the company expected to increase its overall payout rate in the future, it stands out as an attractive option for income-seeking investors.