Stock-split euphoria has taken hold of Wall Street, with a select few stock-split stocks standing out as incredible bargains.

It’s been quite the year for Wall Street. The broad-based S&P 500 produced its worst first-half to a year in more than a half-century, while the growth stock-driven Nasdaq Composite tumbled by more than 30%. Consumers are dealing with historically high inflation (9.1% in June 2022), as well as the ripple effects on the energy supply chain of Russia invading Ukraine. To top things off, the COVID-19 pandemic is still ongoing and adversely impacting supply chains globally.

Yet amid this chaos, investors have developed a case of stock-split euphoria. A stock split is a way for a publicly traded company to alter its share price and outstanding share count without having an effect on its market cap or operating performance. A forward stock split, which is what tends to get investors most excited, reduces the nominal share price of a stock and makes it more affordable for retail investors.

Forward stock splits are almost always viewed as bullish events. The thinking here is that a company wouldn’t need to split in the first place if it wasn’t executing on its growth strategy and hadn’t seen its share price rise as a result.

But among this veritable sea of stock-split stocks in 2022 stands two widely held companies that are historically cheaper than they’ve ever been and are begging to be bought by patient investors.

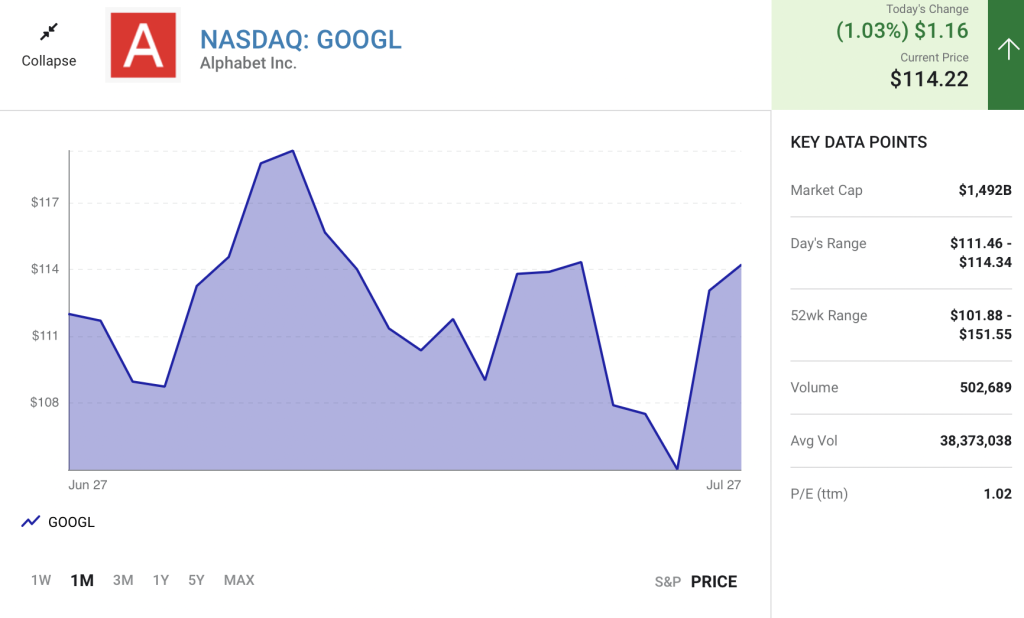

Alphabet

Without question, the no-brainer buy among this year’s stock-split stocks is Alphabet(GOOGL 1.03%) (GOOG 0.87%), parent company of internet search engine Google and streaming platform YouTube.

Alphabet actually kicked off stock-split mania by announcing in February that, with the approval of its shareholders, it would split its shares 20-for-1. The company ultimately gained the requisite approval of its shareholders and began trading at its post-split price on July 18.

Like most FAANG stocks, Alphabet has been put through the wringer this year. There appears to be growing evidence that a recession is brewing or possibly already here. Since the lion’s share of the company’s sales is derived from advertising, and ad revenue is among the first things to be hit during a recession or economic contraction, there’s genuine worry that Alphabet could be fighting an uphill battle in coming quarters.

However, analyzing Alphabet’s operating performance over one or two quarters isn’t the correct approach. If investors widen the lens and take into account its numerous sustainable competitive advantages and long-winded growth opportunities, they’d likely realize it’s one of Wall Street’s top bargains.

Take the company’s foundational internet search engine segment as a perfect example. For the past two years, Google has practically been a monopoly. Data from GlobalStats shows that it’s held between 91% and 93% of global internet search market share. This virtually insurmountable market share lead is what affords the company such impressive ad-pricing power. It also explains why Google has grown by a double-digit annual percentage (save for the initial stages of the COVID-19 pandemic) for two decades.

There’s also YouTube, which has blossomed into the second most-visited social media site on the planet (2.56 billion monthly active users). Although ad sales have slowed in recent quarters as recession worries mount, YouTube appears to be pacing close to $30 billion in annual ad sales. Additionally, don’t overlook YouTube’s premium subscriptions as a growth driver.

But it’s Alphabet’s cloud service infrastructure segment, Google Cloud, which is most impressive. Google Cloud is the world’s No. 3 cloud service provider by total revenue, and it’s been consistently growing by 40% to 50% on an annual basis. Although it’s a bottom-line drag for the moment as Alphabet invests aggressively in cloud, it could easily become the company’s leading operating cash flow driver by mid-decade.

Over the past five years, Alphabet has traded at an average of 26.4 times Wall Street’s forward-year earnings forecast for the company, as well as 19.2 times cash flow. You can pick up shares of Alphabet right now for less than 17 times Wall Street’s forecast earnings for 2023 and less than 9 times forecast cash flow for 2025. It’s a screaming buy at these levels.

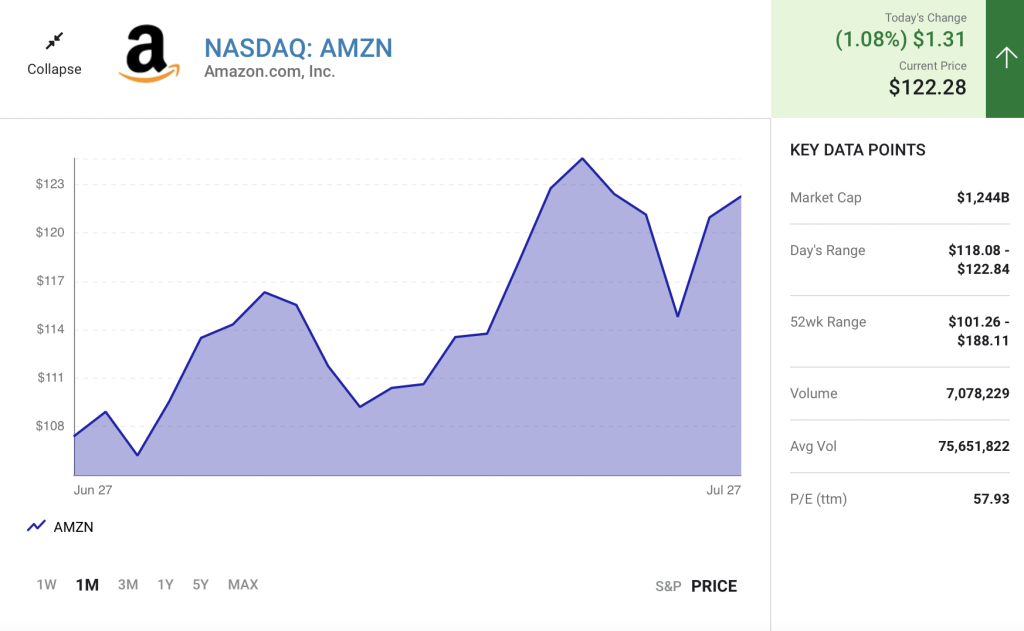

Amazon

Perhaps unsurprisingly, the second stock-split stock that’s historically cheap and begging to be bought by opportunistic long-term investors is FAANG stock Amazon (AMZN 1.08%).

Amazon rode Alphabet’s coattails and announced its intention to conduct a 20-for-1 forward stock split in March. However, it beat Alphabet to the punch by gaining shareholder approval and executing its split on June 6.

Consistent with prevailing recessionary fears, Amazon’s shares have come under pressure in 2022. As a company that generates the bulk of its revenue from e-commerce sales, historically high inflation and a potential economic slowdown represent a worrisome combination. It also doesn’t help that retail giant Walmart issued a profit warning following the closing bell on July 25.

But just as with Alphabet, examining a one- or-two-quarter performance for Amazon won’t tell you a lot about where this company is headed. If you really dig in and look at the big picture, you’ll see a company where practically everything is going right, even in the wake of historically high inflation.

Most people are familiar with Amazon because of its leading online marketplace. In March, eMarketer released a study estimating that Amazon would collect just shy of 40% of all online retail sales in the U.S. in 2022. By comparison, the company’s 14 closest competitors are only expected to account for 31% of e-commerce sales in the U.S. on a combined basis.

Yet retail sales are a capital-intensive and generally low-margin segment for Amazon. Though e-commerce is responsible for most of the company’s sales, it’s the ancillary opportunities created from e-commerce, as well as Amazon’s other operating segments, that are key to its success.

As an example, Amazon’s online marketplace has helped the company sign up more than 200 million Prime members worldwide. That’s tens of billions of dollars in annual fees the company collects from Prime, which it’s able to use to support its vast logistics network, undercut brick-and-mortar retailers on price, or perhaps reinvest in other high-growth initiatives.

The fascinating aspect about Amazon is that its leading online retail segment could generate no growth or modestly negative growth, and the company’s operating cash flow can still soar. That’s because it’s generating considerably juicier operating margins from advertising, subscriptions, and cloud services.

Whereas Google Cloud chimes in as the world’s No. 3 cloud-service provider with 8% share, Amazon Web Services (AWS) accounted for 33% of global cloud service sales in the first quarter, according to Canalys. AWS has been growing by 30% to 40% annually. Even though AWS only accounts for roughly an eighth of Amazon’s net sales, it’s consistently been the company’s leading generator of operating income.

Over the trailing five-year period, Amazon has averaged a multiple of 31.1 times its operating cash flow. This is a premium that Wall Street and investors have been comfortable paying for shares of Amazon since 2010. Yet based on Wall Street’s consensus, Amazon could more than triple its cash flow by 2025 (relative to 2021), and it would be valued at a multiple of 8.6 times cash flow. That makes it historically cheap and an ideal stock-split stock for long-term investors to buy right now.

Read Next : “The next Apple” at less than $10?

One stock is causing quite a stir on Wall Street.

It has so much potential, Forbes asks whether it could be the next Apple or Microsoft.

Because of its business model, I personally feel it’s more likely the next Amazon.

But it really doesn’t matter whether it’s the next Apple, Microsoft, or Amazon.

What matters is this:

- The company uses the most advanced technology on the planet.

- Its stock is trading for less than $10 (for now…), and

- Some of the world’s biggest investors, including Bill Gates and Cathie Wood, are investing millions into it.

An international conference recently took place in Amsterdam that focused on thebreakthrough tech behind this stock, which could explode any day now.

Get the full details on this incredible stock right here.