When a company creates a significant amount of value over the long term, its stock price generally delivers strong gains. In some cases, it may rise so much that a single share costs hundreds or even thousands of dollars. That can make such winning companies a little pricey for many retail investors.

To bring their shares back into easier reach for retail investors, companies can conduct stock splits, and in 2022, a host of big technology companies are doing just that. Google parent Alphabet (GOOGL -5.63%) (GOOG -5.81%) was the most recent. On July 15, it split its stock 20-for-1, giving each shareholder 19 additional shares for each one they already owned, and reducing the per-share price commensurately from $2,235.55 to $111.77.

But Alphabet almost certainly won’t be the last high-profile stock to split this year.

Stock splits add no real value

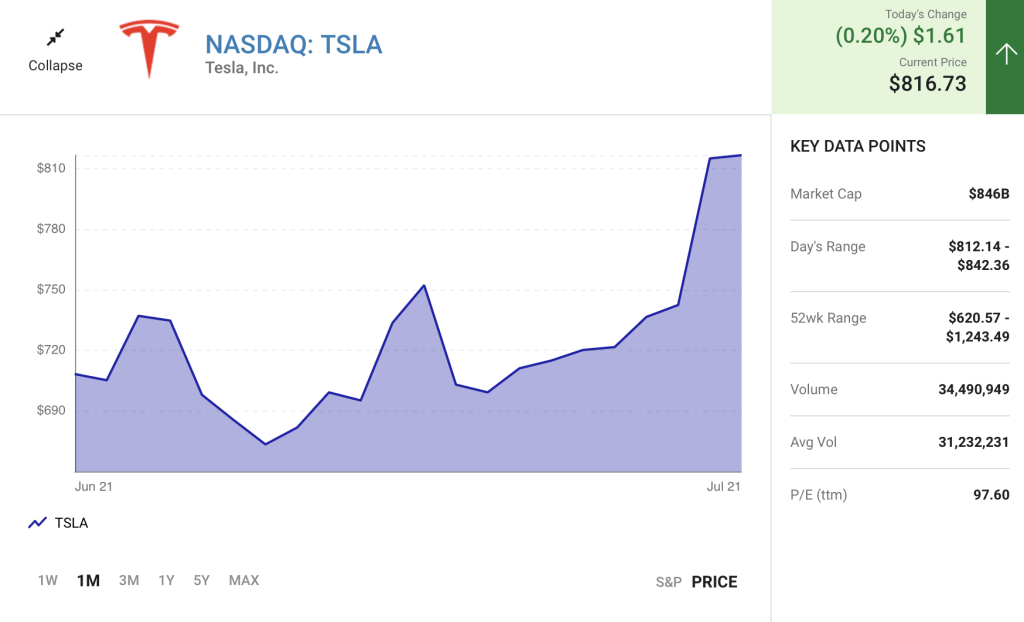

Electric vehicle (EV) powerhouse Tesla (TSLA 0.20%) — shares of which closed Thursday’s session trading at just above $815 — has indicated that it wants to conduct a 3-for-1 split, but management must get shareholder approval for the move first. A vote on the proposal will occur at the company’s annual meeting in August.

Stock splits are almost entirely cosmetic and add no intrinsic value to any company (though they can create situations that lead to a higher demand for shares). They do, however, require investors to adjust any previous per-share metrics they might be comparing to future ones. For example, earnings per share figures Tesla reported before the split will need to be divided by three to properly track the metric’s changes in a way that reflects the new share count.

The EV maker generated $9.5 billion in net income over the last four quarters, equivalent to $8.30 per share. But after the split occurs, that earnings per share number should be divided by three to become $2.77. In all of Tesla’s earnings reports after the split (assuming it is approved), the company will make these retroactive adjustments for you.

Focus on Tesla’s business, not the stock split

This will be Tesla’s second stock split since 2020, and the soaring share price that made it necessary is a testament to the company’s operational success. Tesla has become the world’s leading manufacturer of electric vehicles, and it has drawn praise from its fiercest competitors.

The company has delivered 1.1 million EVs over the last four quarters, a 57% increase compared to the prior 12-month period. That gain came despite an uncharacteristic drop in deliveries in the second quarter of 2022 that was caused by a series of production challenges. The company had to shut down its Shanghai, China, facility for weeks during the quarter because that city was put under a COVID-19 lockdown. Tesla also faced global supply chain challenges that included a shortage of semiconductors.

The key takeaway? Tesla delivered fewer cars in the quarter not because consumers wanted fewer cars, but because it simply couldn’t make enough.

As a result, Tesla’s Q2 revenue came in at $16.9 billion, a 9.7% drop compared to Q1. However, it still amounted to 42% year-over-year growth, so the trend is still definitely up over the longer term.

Tesla’s future holds an abundance of promise

Tesla’s production issues are likely a short-term phenomenon. It opened two new gigafactories in 2022 — one in Austin, Texas, and the other in Berlin, Germany — that are set to double its manufacturing capacity to 2 million vehicles annually.

Those are just a few more steps on a journey that management has said will lead to it churning out 20 million cars a year by 2030.

But this story extends beyond electric vehicles. Tesla wants to be a global leader in green energy overall, and it’s reporting record-high demand from customers for its residential solar power and storage products. In fact, the company is struggling to produce these items quickly enough to meet demand.

That’s why it’s important for investors to maintain a long-term focus when buying Tesla shares. Its stock trades at a price-to-earnings ratio of 89, which appears expensive compared to the Nasdaq-100 index’s ratio of 24.6.

But while shareholders are baking a lot of future growth into Tesla’s current stock price, this is a once-in-a-generation company that continues to bounce from strength to strength. As long as investors buy in with a time horizon of a decade or longer, it’s a bet that has a great chance to pay off.