These stocks are trading at significant discounts to their historical valuations.

Recession fears have weighed heavily on the stock market through the first half of the year. In fact, the broad S&P 500 had its worst first half since 1970, and the Nasdaq Composite is currently 25% off its high, putting the tech-heavy index in bear market territory.

On the bright side, tumbling prices mean that many stocks are now trading at discounts to their historical valuations, and that creates an opportunity for patient investors. Here are two growth stocks worth buying right now.

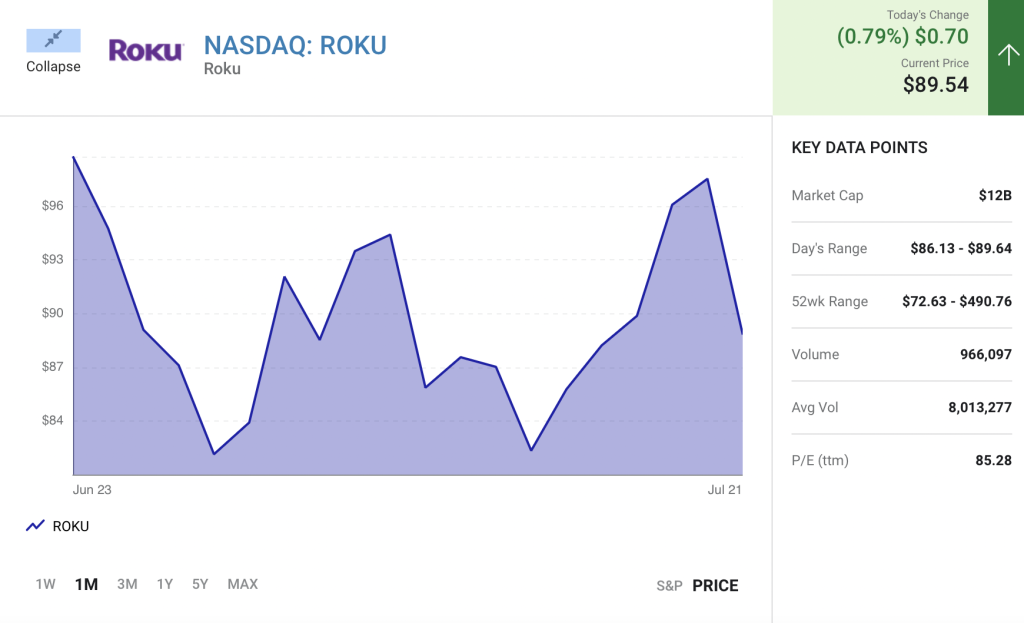

1. Roku

Roku (ROKU 0.79%) helped pioneer the streaming industry. In 2008 it brought the first streaming player to market, not long after Netflix introduced the first streaming service. Today, RokuOS is still the only operating system purpose-built for television, and its viewer-friendly reputation has led to partnerships with a growing number of television manufacturers. That has helped Roku position itself as the most popular streaming platform in the U.S., Canada, and Mexico.

Meanwhile, Roku has also built a powerful ad tech platform, OneView, which enables advertisers to deliver targeted campaigns across connected TV (CTV), mobile, and desktop devices. That means Roku can monetize advertising whether or not it owns the inventory.

In the first quarter, Roku reported a 14% increase in streaming hours, marking a deceleration in engagement. But that came on the back of a pandemic-driven acceleration in the prior year, when viewing time soared 49%. More importantly, Roku still outpaced the industry average of 10% growth, meaning it gained market share. That led to reasonably strong financial results, as revenue rose 44% to $2.9 billion and cash from operations climbed 18% to $234 million.

Turning to the future, investors have good reason to be bullish. U.S. viewers currently spend 46% of their television time on streaming, but advertisers spend just 18% of their television budgets on streaming. In the coming years, investors should expect more ad dollars to shift to streaming platforms, and Roku is well-positioned to benefit from that trend.

On that note, global television ad spend will reach $344 billion by 2026, according to IMARC Group, and Roku CEO Anthony Wood believes all television advertising will eventually be streamed. That creates a tremendous opportunity for the company.

Shares currently trade at 4.7 times sales, much cheaper than the three-year average of 15.5 times sales. That why this growth stock is a screaming buy.

2. Block

Block (SQ -0.17%) breaks its business into two segments: Square and Cash App. Through the Square ecosystem, sellers can provision all of the hardware, software, and services they need to run a business across online and offline locations. That differentiates Block from traditional merchant acquirers (e.g. banks), which often bundle products from different vendors, leaving merchants with a patchwork of solutions that must be manually integrated.

The Cash App ecosystem takes a similarly disruptive approach. Consumers can deposit, send, spend, and invest money from a single mobile app, and they can file their taxes for free. Better yet, where banks with physical branches typically pay at least $300 to acquire a new customer, Block pays just $10 to acquire a new Cash App user, making its business model much more efficient.

In short, Block is disrupting the financial services industry for both merchants and consumers, and that has translated into strong financial results. In the past year, gross profit climbed 50% to $4.8 billion and the company generated $965 million in free cash flow, up from a loss of $344 million in the prior year.

Looking ahead, Block is well-positioned to grow its business. The company is working to unlock synergies between Square and Cash App by integrating Afterpay — its recently acquired “buy now, pay later” (BNPL) platform — into both ecosystems.

Specifically, Square sellers will be able to accept BNPL online and in person. That should drive sales growth, simply because BNPL tends to boost transaction volume. But those sellers will also be able to use shopper data to deliver targeted recommendations to consumers through the Cash App, which could further boost sales.

Currently, Block puts its addressable market in the U.S. at $190 billion in gross profit, but the company also operates in Canada, Japan, Australia, and the U.K., and it recently entered Ireland, Spain, and France. That means Block has a long runway for growth, and with shares trading at 2.3 times sales — near the cheapest valuation in the past five years — now is a great time to buy this growth stock.