Even after the stock market’s rally the past few weeks, 2022 has been a horrible year for most investors. And it’s quite possible things could take a turn for the worse again. Inflation is at 40-year highs, gasoline prices are still well above $4 per gallon, the housing market is starting to fall, supply chains remain snarled, and inventory levels remain high. The U.S. economy has contracted for two consecutive quarters (the commonly accepted — though unofficial — definition of a recession).

Smart investors want to play it safe. That means seeking out dividend stocks, which tend to outperform stocks that don’t pay a dividend even when the market isn’t in turmoil. Yet in the short term, even the best stocks can lag behind, which gives investors a great opportunity to pick up shares of a quality company at a discount.

The following pair of safe dividend-paying stocks have been left behind by the market, performing even worse than the broad index. It’s a unique chance to buy them and realize the long-term gains they’ll eventually generate, while enjoying a steady stream of income in the meantime.

1. Illinois Tool Works

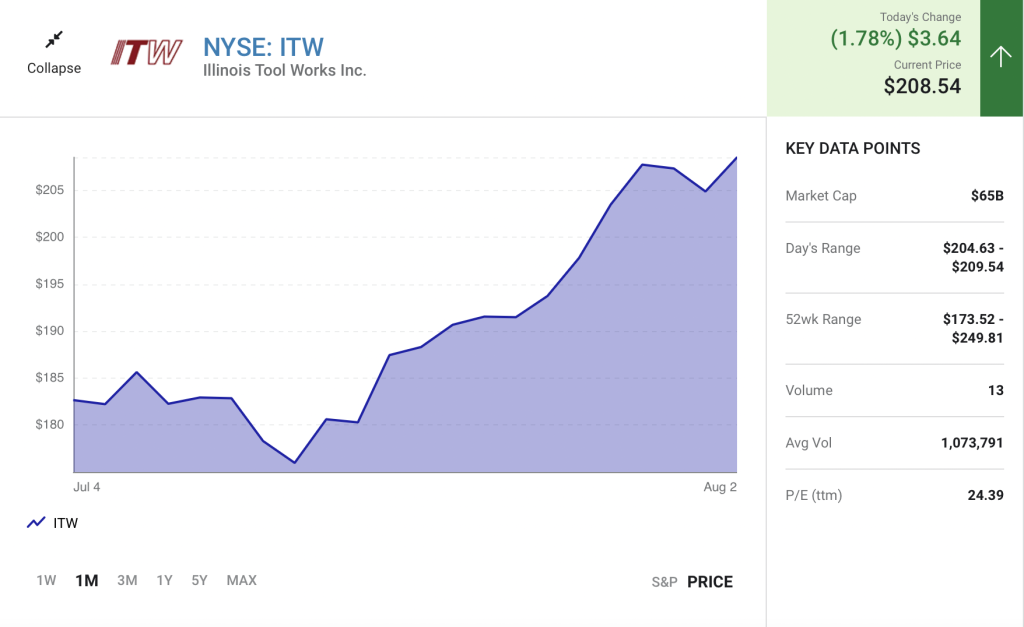

It’s not like Illinois Tool Works (ITW 1.78%) is unknown, as dozens of Wall Street analysts cover the stock, but it still flies under the radar of many investors. That’s likely because it’s not a sexy, fast-growing tech stock, but rather a slow and steady business. It serves the automotive, food service, and test and measurement sectors, along with welding, polymers and fluids, construction, and specialty products industries.

None of those are particularly exciting, and they also indicate why Illinois Tool Works’ stock is down 16% this year at Wednesday’s prices: In recessionary times, orders decline, and this stock reflects the general mood.

Still, it tends to remain very profitable throughout downturns, and because its products are so crucial to businesses across broad swaths of the economy, it inevitably leads to significant gains in the years afterward.

Illinois Tool Works pays an annual dividend of $4.88 per share that yields 2.4% at recent prices. It’s been in business for over 100 years, and it has increased its dividend for over 50 straight years, making it a Dividend King. While there could be near-term challenges to overcome, Illinois Tool Works’ long-term story remains intact, and weakness in its stock should be viewed as an opportunity to buy.

2. Stanley Black & Decker

In a very similar situation is Stanley Black & Decker (SWK -0.38%), another company whose history stretches back well more than a century — and one that has paid a dividend for 145 years. It has also steadily increased the payout every year for the last 57 years, putting it in that same elite group of Dividend Kings.

Over those years, Stanley has evolved into a premier hand-tool and power-tool company, amassing a portfolio of brands familiar to every homeowner and professional. Beyond the Stanley and Black & Decker brands (the two companies merged in 2009), it also owns DeWalt, Porter-Cable, Bostitch, Mac Tools, Irwin, Proto, and Craftsman. In December, it acquired MTD Products, which makes a line of outdoor power tools.

Less well known to the layperson is that Stanley also has a significant presence in the industrial and healthcare markets. It produces engineered fasteners for the aerospace and oil and gas industries, infrastructure components for roads and bridges, and systems to monitor elderly patients to detect wandering and falls.

Stanley just reported earnings last week that missed on the top and bottom lines, and the toolmaker cut its guidance for the year because, like Illinois Tool Works, it also feels the effects of a slowing economy. That’s helped send the stock down roughly 50% this year.

Yet Stanley also has remained profitable during these downturns, and its dividend (which yields about 3.3% as of Wednesday’s prices) is in no danger of being cut. With a payout ratio of 51% — meaning just over half of net income goes to paying the dividend — there’s plenty of room for Stanley Black & Decker to give more cash to shareholders, just as it has for more than a half-century.

Read Next: CEO of Biggest PE firm predicts “social unrest”

I don’t know if you’ve seen this or not yet…

But Stephen Schwarzman, the CEO of Blackstone (America’s biggest private equity firm), recently went public on CNN predicting America is about to see serious “social unrest”. (to see why click here)

Schwarzman said: “You’re going to get very unhappy people around the world… What happens then, is you’ve got real unrest. This challenges the political system…”

Bill Bonner, an ultra-wealthy entrepreneur who started what is probably America’s biggest financial research firm more than 40 years ago, agrees…

Bonner says,

“We are about to enter a very strange period of time in America.”

“What I see on the horizon could be the worst U.S. crisis ever…which could likely be followed by riots and ultimately some form of revolution.”

What has these two super-successful and wealthy men so concerned?

Well, Bill Bonner recently went public with a full explanation, from one of his three European properties… overlooking the Blackwater River. (View for free on our website here)

Over the past 50 years, Bonner has made three macro-economic predictions… all of which came true.

And today, from his 60-acre property, he’s issuing what he calls: His 4th and Final Warning. He says…

“I believe it falls on someone like me to warn people… clearly… and without distraction.

“I can do this now because I’m too rich to care about money… and too old to care about what anyone says about me.”

Get the facts. Learn how to protect yourself (Bonner explains his 4 recommended steps), and get a peek inside one of his spectacular properties.

We’ve posted Bonner’s full analysis and footage of his property on our website. You can view it free of charge, right here…