Microsoft just reported a mixed first quarter of fiscal 2023, but its long-term strategy is worth investing in.

Considering the steep losses in the stock market this year — particularly those in the technology sector — investors are paying close attention to the current earnings season. Large organizations can provide helpful hints about the health of the consumer and the economy, so it’s important to keep an eye on their results.

Microsoft (MSFT 2.49%) released its fiscal 2023 first-quarter report on Oct. 25, and it showed signs of weakness particularly in its consumer-focused segments. While that’s a symptom of a sputtering economy, its cloud business put up much stronger results.

Microsoft CEO Satya Nadella remarked that the company would prioritize the areas set to benefit most from long-term trends toward digital technology, and the cloud fits squarely into that mold. Despite Microsoft stock falling by 7% following the Q1 report, here’s why investors should take positivity from the company’s strategy and buy it on the dip.

The cloud shines yet again

Microsoft’s greatest strength is its operational diversity. Its Windows operating system and Office 365 document suite are the company’s claims to fame, and they’re still used by billions of people around the globe. But Microsoft has grown far beyond those roots with a business that now includes a suite of other highly successful segments.

It has a formidable hardware business driven by the Surface line of notebooks and tablet devices, a gaming unit led by the Xbox console, and perhaps most notably, a booming cloud segment powered by the Azure platform. In fact, it was the highlight of Microsoft’s financial results during fiscal 2022 (ended June 30), and the strength carried over into the recent first quarter of fiscal 2023.

Microsoft’s total revenue grew by 11% in Q1, but its intelligent cloud segment, which is now the largest of the company’s three main business units, grew by a much quicker 20%. And Azure, which falls under intelligent cloud, expanded by a whopping 35%.

Among its hundreds of different solutions for businesses, Azure is building advanced tools by using artificial intelligence and machine learning. Azure Machine Learning (ML) allows developers to create models for a range of purposes from beginning to end — from the simple data labeling stage right through to deployment and management.

While Microsoft doesn’t disclose its revenue for this segment specifically, the company says Azure ML has doubled its sales in each of the last four quarters.

The short term might be bumpy for Microsoft

The combination of high inflation and rising interest rates is making life difficult for consumers financially, leaving them with less disposable income. It has dealt a blow to Microsoft’s personal computing segment, where revenue has now declined for three consecutive quarters on the back of slowing device sales growth, less Xbox user engagement, and shrinking Windows revenue.

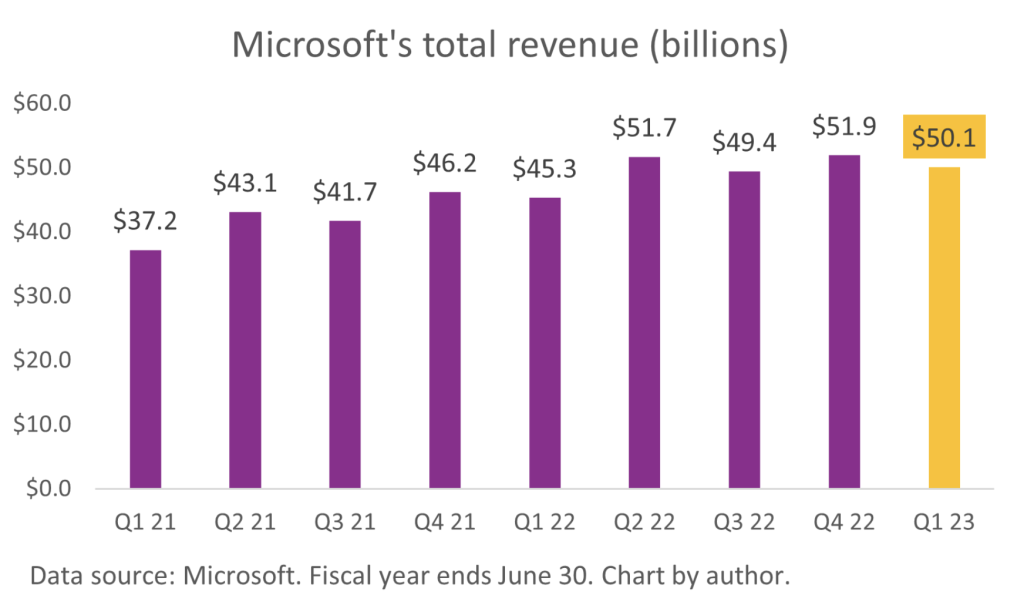

It has been a drag on Microsoft’s total revenue, though despite some bumps in the road, that metric is still trending in the right direction over time.

Revenue of $50.1 billion was within the range of Microsoft’s guidance for Q1, though slightly below the $50.25 billion mark it estimated at the high end. Slowing revenue does have implications for the company’s profitability, as there’s less money coming in to soak up rising costs. This contributed to a 13% year-over-year decrease in Microsoft’s earnings per share, to $2.35.

Why Microsoft stock is a long-term buy

Despite slower overall growth in the short term, Microsoft’s keen focus on the cloud-based areas of its business could kick-start the company’s performance in the long run. That’s because the cloud industry is still maturing; while it’s estimated to be worth $483 billion in 2022, the opportunity could triple to $1.5 trillion each year from 2030 (according to Grand View Research).

Azure is already near the top of the industry, ranked second only behind Amazon Web Services. That places it in a great position to capitalize on the corporate world’s seismic shift toward digital technologies to power operations.

But there’s no shortage of potential in Microsoft’s other segments because the company’s consumer-focused brands like Surface and Xbox should get a lift once the economy recovers. Plus, it continues to innovate on the gaming side, particularly off-console with its cloud gaming platform. It enables users to access their favorite titles from anywhere, on any device, and Microsoft says over 20 million people have streamed games on the service to date.

Microsoft has a valuation of over $1.7 trillion but that hasn’t triggered any complacency, nor has it stifled the company’s drive to innovate in several different areas. That’s why investors should buy the stock for the long run, especially since it’s down 32% so far in 2022.

Read Next – New battery “could eat lithium’s lunch”

Every single Tesla electric vehicle is powered by a lithium-ion battery.

It transformed Tesla from the laughing-stock of the auto industry into the biggest car company in history.

But according to Bloomberg…

This new battery technology “could eat lithium’s lunch.”

It’s a “breakthrough,” says the U.S. Department of Energy. That’s a “totally new approach to battery technology.”

Powermag says it is “the trillion-dollar holy grail” of battery technology.

And that’s just the beginning…

Because according to Forbes, a $130 trillion revolution in energy is coming.

And this new battery could be at the center of it all.

Best part…

Right now, one tiny company behind this new battery technology trades for around $4.

It’s such a huge opportunity, five billionaires have already invested.

Bill Gates, Jack Ma, Richard Branson, Michael Bloomberg, and Jeff Bezos are all backing this tiny company.

And the reason is simple.

This new battery can store energy up to 94% cheaper than a Tesla lithium-ion battery.

I urge you to click here to check out the full story.

And lock in shares now for $4…

Not $40 or $400 – or $900 like Tesla shares trade for now.

Click here for the full story.