These players offer you passive income and a whole lot more.

Just imagine yourself sleeping tranquilly — not even worried about the stock market’s performance. And as you sleep, the money comes rolling in. Sound like a dream? Well, it’s not. There’s actually a way to make money this easily every year – even when the market is down.

And that’s by owning dividend stocks. Buying Dividend Kings is a great way to start because these companies have a long track record of increasing payouts. This shows rewarding investors is important to them. So they’re likely to continue this policy. But before you head off to get some shuteye, let’s check out three Dividend King stocks to buy.

1. Coca-Cola

Coca-Cola (KO -0.19%) is a strong and steady player that makes a great addition to your portfolio — for its dividend payments and earnings track record.

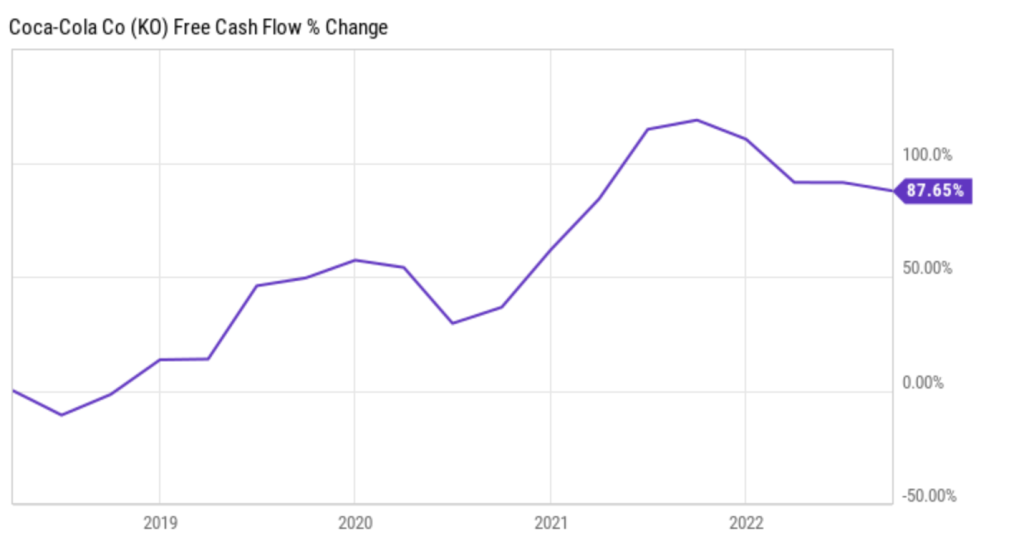

Let’s look at the dividend first. The world’s biggest non-alcoholic beverage company pays an annual dividend of $1.76 per share at a yield of 2.77%. It’s raised the payment for the past 60 consecutive years. And its overall increase in free cash flow over time shows the company has what it takes to keep dividend payments growing.

Now, let’s talk earnings. Investors like that Coca-Cola’s brand strength keeps growth going even in difficult economic times. For example, in the third quarter of last year, Coca-Cola reported double-digit growth in net revenue and earnings per share. That was in spite of headwinds like unfavorable currency exchanges and higher inflation. And Coca-Cola has generally increased earnings over time too.

Coca-Cola stock performance alone probably won’t supercharge your portfolio. But over the long haul, steady gains and a dividend you can count on could make it a valuable part of your holdings.

2. Target

Target (TGT 1.92%) has lifted its dividend for the past 51 years. The retail giant now pays an annual dividend of $4.32 per share. This represents a dividend yield of 2.90%. This means if you hold 100 Target shares, the company will pay you $432. This is welcome any time — but it’s particularly appreciated during tough market times.

Of course, the earnings picture at Target may look a little glum these days. The company’s growth has cooled, and margins have narrowed amid today’s economic troubles. Target said in the fall that rising inflation is weighing on its customers’ wallets — and that impacts how they shop at Target. For example, they’re focused on buying essentials only or items on sale.

Still, Target has managed to increase comparable sales, make gains in market share across product categories — and Target has launched a plan to improve efficiency that could cut costs by $2 billion to $3 billion. Also, today’s economic troubles won’t last forever. Target has the strength to thrive in better days — and offer you solid returns.

3. Johnson & Johnson

Johnson & Johnson (JNJ -0.16%) is another top company you can count on to pay you just for owning its stock. The big pharma player pays an annual dividend of $4.52. The dividend yield is 2.56%. That’s higher than the average yield of 2.15% for the industry, according to data gathered by NYU’s Stern Business School.

So, buying J&J for dividend payments is a good idea. But there’s another great reason to get in on J&J right now too. The company is spinning off its consumer health business — its lowest-growth business — this year. That means it will focus on its two higher growth businesses: pharmaceuticals and medtech. As it stands, J&J has increased revenue over time. This transition should help it continue along that path.

J&J shares beat the bear market last year. But even after that performance, J&J shares remain reasonable at about 16 times forward earnings estimates. That looks like a great price for a company embarking on a new growth story — and ready to pay investors while they sleep.

Read Next – “Future Fuel” will unleash $11 trillion wave of wealth

A brand new type of fuel has just been created that could put Tesla out of business.

Forbes, CNN, and Nature Magazine are calling it the “fuel of the future.”

And this “Future Fuel” is set to unleash an energy revolution that Goldman Sachs estimates will be worth $11.7 trillion.

That’s 10X bigger than the electric battery market.

Don’t forget — Tesla has returned 41,405% to shareholders over the last 10 years.

But the amount of wealth up for grabs from the “Future Fuel” revolution could put those returns to shame.

That’s why billionaires like David Shaw and Jeff Yass are pouring hundreds of millions of their own money into this “Future Fuel.”

And top Tesla executives are fleeing the company en masse in order to take part in the “Future Fuel” revolution.

They know what’s coming.

They know that “Future Fuel” will mint an entire new class of millionaires — maybe even billionaires.

And early investors will make an absolute fortune.

All the details of the “Future Fuel” revolution are right here.

See how you could take part in this historic wave of wealth today.