Neither of these companies is about to slash its payout, but headwinds are mounting.

The larger the dividend a stock pays in proportion to its price, the more tempted investors may be to buy a few shares and hopefully lock in that passive income stream. But no matter how tasty a high-yield stock might look, it’s key to remember that dividend yields rise when share prices fall — and often that’s because the company isn’t as solid as one might hope.

With that in mind, let’s examine a pair of dividend payers with decently high yields that are riskier than their conservative business models might make them seem.

1. Walgreens Boots Alliance

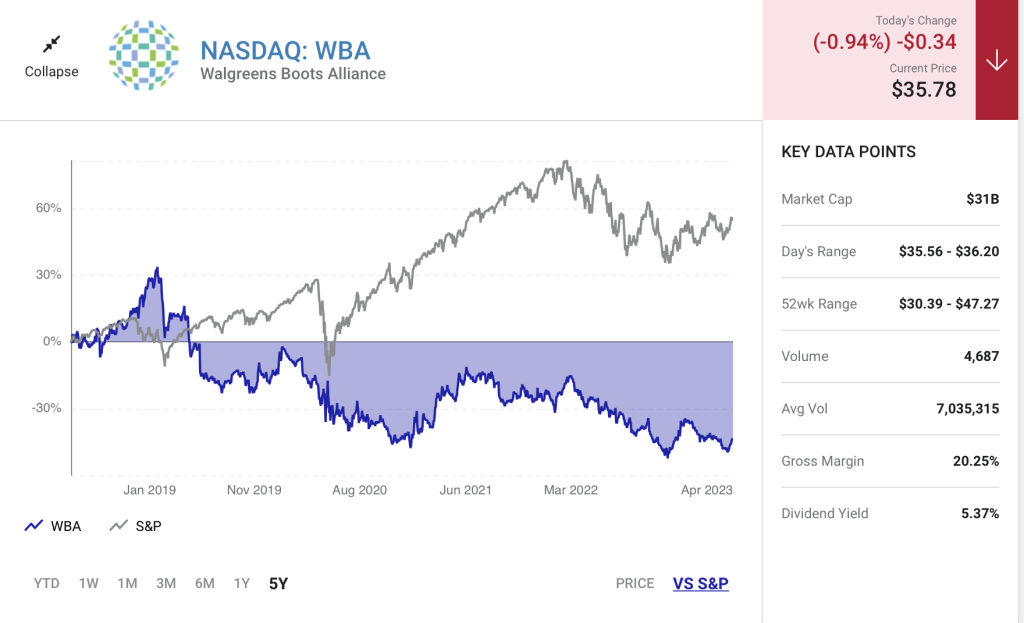

With a forward dividend yield of more than 5.9%, Walgreens Boots Alliance (WBA -0.94%) seems like an obvious contender for a spot in many people’s income portfolios. The international pharmacy company has the benefit of valuable high-traffic real estate in a smattering of U.S. cities, where loyal local clienteles rely on its stores for their prescriptions.

It’s also angling to get into delivering primary care, post-acute care, and even specialty care at its locations, all of which could be drivers for growth.

Overall, people will always need the services Walgreens provides, and in recent history, the business was narrowly profitable. Since 2013, its profit margin has averaged around 2.8%.

The trouble with Walgreens is that it’s making less money over time while its dividend is rising. Over the last 10 years, its payout grew by 75%, but in the most recent quarter, its earnings per share (EPS) fell by just over 20% due to receding demand for its preventative and therapeutic offerings against the coronavirus.

It’s also starting to see significant servicing costs for its $36.4 billion in debt. In its 2022 fiscal year, it repaid $8.3 billion, but it borrowed almost $12 billion more at the same time. Eventually that debt will come due, meaning that debt repayments will continue to be a major headwind.

Furthermore, the company’s streak of raising its dividend extends for 47 years and running, but its ratio of its trailing-12-month net income to its dividend is negative, which means it’ll have a hard time covering its payout with its earnings unless something changes. That seems like a reason to believe the dividend’s growth may not continue even if the dividend remains.

Still, continuing to pay a dividend at all is going to be increasingly hard to justify when top-line growth is hard to come by and earnings are struggling. Remember, money paid out to shareholders can’t be invested for growth. And if there isn’t enough such investment in growth, eventually the company might need to slash the dividend to keep the lights on anyway, which could well be Walgreens’ situation in a few years time.

2. PetMed Express

PetMed Express (PETS -0.96%) is another pharmacy business, except it caters to companion animals and mails prescriptions to owners rather than operating retail locations. It’s also trying to diversify into providing pet insurance, pet telehealth, and selling pet wellness products, all of which management is counting on to shore up its lagging growth. Its dividend currently yields 7.1%, which is likely high enough to tempt investors with a purchase — but there’s more to the story.

Much like Walgreens, PetMed’s dividend doubled over the last 10 years, but its quarterly net income and free cash flow have both declined. Its total expenses have ballooned as a proportion of its revenue, and now its profit margin is a mere 4.3%, with little reason for improvement in sight.

Its payout ratio is above 214% of its annual earnings, which is a red flag for the sustainability of its dividend. To make matters worse, in Q3 of its fiscal 2022, sales fell 3% year over year to $58.9 million despite signing on 9% additional new customers over the prior year.

So PetMed’s growth strategy doesn’t appear to be working. But, its dividend is a bit safer than Walgreens, even if ongoing trouble with remaining profitable makes its future look a bit less than sunny. The company has nothing in terms of debt, and it can count on largely retaining its base of roughly 2 million customers, most of whom would recommend the business to a friend, per management.

Don’t invest in this stock with the idea that its dividend is ironclad, but don’t assume that it’s going to go out of business either. There’s still a chance that its management will be able to engineer a turnaround as a result of its attempts to enter pet health markets that are adjacent to its pharmacy-by-mail service.

Read Next – Secret Gold Back currency RUINING Biden’s plans for a digital dollar?

There is a secret currency that’s beginning to spread across America.

And you only have a limited time to claim one of these “Gold Dollars” for yourself.

And since it is made out of REAL gold…

You can understand why I have a limited quantity to give out today.

You just have to watch this short 2 minute video I recorded for you and respond by immediately.

If you don’t respond, you’ll forfeit this offer and these “Gold Dollars” may be gone for good.

Click here now for the details.