A modest amount of money can go a long way when it’s put to work in industry-leading businesses.

As much as investors would love for the major stock indexes to rise without interruption, history shows that corrections and bear markets are a normal part of the investing cycle. Since the start of 1950, the broad-based S&P 500 has undergone 39 separate double-digit percentage corrections, including the 2022 bear market.

But history also makes clear that every one of these notable drops has been a buying opportunity. Despite never knowing when corrections will occur, how long they’ll last, or where the ultimate bottom will be, we do know that that every decline is eventually cleared away by a bull market. With all three of the major stock indexes meaningfully below their all-time highs that were set between November 2021 and January 2022, bargains can still be found.

What’s particularly advantageous about putting your money to work on Wall Street is that most online brokerages have removed barriers to investment. Minimum deposit requirements and commission fees on trades made on major U.S. exchanges are a thing of the past for most online brokerages. It means any amount of cash — even $400 — can be the perfect amount to put to work.

If you have $400 that’s ready to invest, and you’re certain you won’t need this money to cover emergencies or pay bills, the following three stocks stand out as no-brainer buys right now.

Verizon Communications

The first exceptional stock that makes for a no-brainer buy with $400 right now is telecom company Verizon Communications (VZ 0.61%).

Although telecom stocks like Verizon are highly profitable, they’ve been contending with two headwinds this year. The first is rapidly rising interest rates, which could make future deals or refinancings considerably costlier. The other concern stems from a report by The Wall Street Journal regarding legacy telecom’s usage of lead-sheathed cables in their networks. The wide variance in potential financial liability tied to these cables has made investors cautious about the industry.

While investors shouldn’t sweep these tangible issues under the rug, focusing too much on short-term noise could mean missing out on a phenomenal bargain.

For instance, telecom companies provide something of a necessary service. Persistently low churns rates suggest that consumers view their smartphones, wireless services, and internet access as basic necessities. This should lead to predictable operating cash flow for Verizon no matter how well or poorly the U.S. economy is performing.

Despite being a mature company, Verizon does have needle-moving catalysts. The ongoing shift to 5G download speeds is arguably the most-prominent. Since it took wireless providers a decade to upgrade download speeds from 4G LTE to 5G, the subsequent device replacement cycle to take advantage of these faster speeds is expected to last years. Verizon should see a modest bump in retail revenue, but should meaningfully benefit from greater data consumption. Data is the key margin driver for Verizon’s wireless segment.

Furthermore, Verizon’s broadband segment has been a beast of late. It’s delivered three consecutive quarters of at least 400,000 net broadband additions. Though broadband will never be the growth story it was two decades ago, it’s still a source of predictable cash flow and can be used as a lure for service bundling.

Lastly, the lead-sheathed cable issue is a near-term nonstarter. Verizon has already stated that lead-sheathed cables make up a small portion of its network. Additionally, it’ll likely take years to determine if the company has any financial liability. At less than 8 times forward-year earnings, and sporting a yield nearing 8%, Verizon stock is sufficiently de-risked.

Fiverr International

A second no-brainer stock you can confidently buy with $400 right now is online-services marketplace Fiverr International (FVRR 1.40%).

With Fiverr stock more than 90% below its all-time high, valuation is no longer a plain-as-day headwind. Instead, it’s the perpetuation of the belief that the U.S. economy is headed for a recession. Economic downturns usually lead to a rise in the unemployment rate, which wouldn’t be ideal for a service that connects freelancers with businesses.

But even with a multitude of economic datapoints suggesting a downturn is on the horizon, it pays to be an optimist. Since the end of World War II, all 12 U.S. recessions have lasted just two to 18 months. That compares to multiple expansions which have lasted many years, if not a full decade. Over long periods, betting on labor market expansion is a smart move.

On a more company-specific basis, Fiverr can thrive on the heels of three well-defined catalysts.

To start with, the labor market appears to have been permanently changed by the COVID-19 pandemic. While some workers have returned to the office, more people are choosing to work remotely than ever before. This shift thrusts freelancer platforms like Fiverr into the spotlight.

Secondly, Fiverr’s freelancer platform stands out from its competition. Whereas many of its peers allow freelancers to price their tasks or services on an hourly basis, Fiverr freelancers are promoting their services as a complete job with a clear price point. This unparalleled price transparency has resulted in a steady uptick in spend per buyer.

Third and most important, Fiverr’s take-rate is a grade above its peers. “Take-rate” describes the percentage of each deal negotiated on its platform that it gets to keep, including fees. In theory, the goal is to continue increasing the take-rate without chasing away freelancers or pushing away buyers. Fiverr’s take-rate has continually climbed, reaching a hearty 30.7% in the June-ended quarter. This take-rate, which is nearly double its closest peers, should help it outperform.

With sustained double-digit growth potential and a forward price-to-earnings (P/E) ratio of just 13, Fiverr has all the hallmarks of a screaming buy.

Meta Platforms

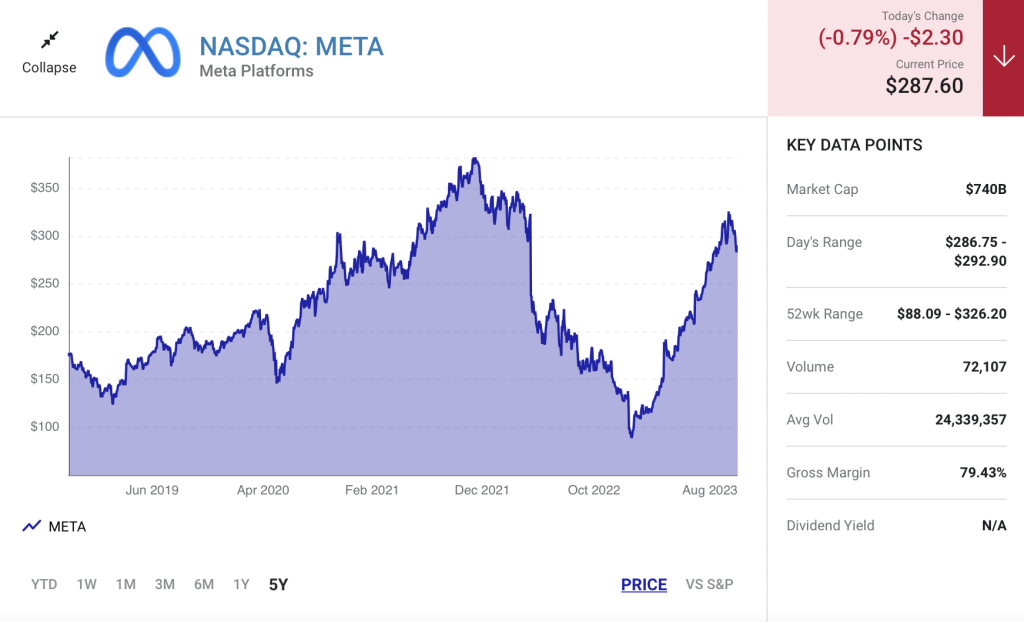

The third no-brainer stock you can buy with $400 right now is none other than social media juggernaut Meta Platforms (META -0.79%). Meta is the company behind Facebook, the most-visited social site in the world, as well as Instagram, WhatsApp, and Facebook Messenger.

If you’re looking for a knock against Meta Platforms, you’ll find two. To begin with, the company is heavily reliant on advertising. Through the first six months of 2023, $59.6 billion out of its $60.6 billion in total revenue has come from ads. If the U.S. economy weakens, advertisers are liable to pare back their spending.

The other concern has to do with how much CEO Mark Zuckerberg is spending on metaverse and augmented/virtual reality innovations. Losses at the company’s Reality Labs segment have been growing annually, with the division on track to lost more than $15 billion this year. Aggressive spending on money-losing segments when the near-term economic outlook is uncertain may not sit well with some investors.

But there are two sides to this story. Although the current ad environment is uncertain, the U.S. economy spending a disproportionate amount of time expanding, relative to contracting, favors ad-driven businesses. The expectation would be that Meta enjoys strong ad-pricing more often than not.

Another catalyst for Meta is its aforementioned social media “real estate.” While other social media sites have come and gone, few have been able to challenge the dominance of Meta’s big four. They’re consistently among the most-downloaded apps in the world. During the second quarter, the company’s family of apps attracted 3.88 billion monthly active users. Eye-popping figures like this are sure to attract advertisers and put the ball in Meta’s court when it comes to ad-pricing power.

While it would be preferable if Reality Labs wasn’t losing money hand over fist, investors should realize that Meta has the cash flow and balance sheet to take risks that most other companies can’t afford. Meta closed out the June quarter with more than $53 billion in cash, cash equivalents, and marketable securities, and has generated $31.3 billion in net cash from operating activities since the year began. The investments it’s making now in the metaverse could make the company a logical on-ramp to augmented/virtual reality environmentsby the second half of the decade.

There’s also Meta Platforms’ valuation, which is considerably cheaper than you might realize. Even with its shares more than doubling on a year-to-date basis, Meta can be purchased for approximately 10 times forward-year cash flow. Since Meta reinvests so much of its cash flow back into its business, I’d argue it’s a better measure of value than the traditional P/E ratio. A multiple of 10 times forward cash flow is a value for a company that traded at an average of nearly 16 times cash flow between 2018 and 2022.