Artificial intelligence has changed the technology landscape, and these two companies should profit from that revolution.

One of the biggest trends to emerge in the stock market over the past couple of decades has been the increasing dominance of technology stocks. Roughly 20 years ago, General Electric and ExxonMobil were the world’s largest companies in terms of market capitalization — worth $319 billion and $283 billion, respectively.

A review of the current list of chart toppers reveals just how much things have changed. Technology titans Apple and Microsoft lead the list, with market caps of $2.8 trillion and $2.4 trillion, respectively. In fact, seven of the top 10 largest companies have technology flowing through their veins.

Artificial intelligence (AI) has driven the stock market rally thus far in 2023 and promises to mint the next generation of “two trillionaires.” Here’s my prediction for the two investor-favorite AI growth stocks that will ride this secular wave and join Apple and Microsoft in this exclusive fraternity over the coming decade — and perhaps much sooner.

1. Alphabet

Alphabet (GOOGL -0.10%) (GOOG -0.03%) has a current market cap of $1.65 trillion and is considered something of a shoo-in to join the $2 trillion club. To achieve that milestone, the stock would only need to increase by roughly 23% from its recent closing price. That works out to about 2% gains annually — hardly a high bar to clear.

It’s worth noting that Alphabet is a former member of this prestigious club. The stock initially surpassed this benchmark in November 2021, just days before the start of the bear market.

Numerous drivers could fuel Alphabet’s ascent. Digital advertising took a big hit during the downturn but has recently turned the corner. The global digital advertising market is expected to climb from $531 billion in 2022 to $1.5 trillion by 2030, achieving a compound annual growth rate of about 14%, according to market research firm Research and Markets.

Alphabet is the undisputed leader in the worldwide digital advertising market, with an estimated 30% share, according to online marketing trade publication Digiday. An expected rebound in online marketing should be enough to propel Alphabet back into the $2 trillion club.

If that weren’t enough, there’s also the opportunity afforded by cloud computing and AI. The emergence of generative AI this year, with the promise of vast productivity gains, has businesses racing to adopt this breakthrough technology.

However, building the large language models necessary to harness this technology can cost millions, and many companies simply don’t have the resources. Cloud infrastructure providers, including Google Cloud, have recognized the opportunity and are making AI available on their respective platforms, which will undoubtedly boost revenue.

Generative AI should generate a huge secular tailwind, and while estimates vary, experts agree there are trillions of dollars at stake. As the fastest-growing cloud infrastructure provider and one of the “big three,” Alphabet is well-positioned to take its share of the AI windfall.

The trifecta of digital advertising, cloud computing, and AI should give Alphabet plenty of traction to rejoin the $2 trillion club.

2. Nvidia

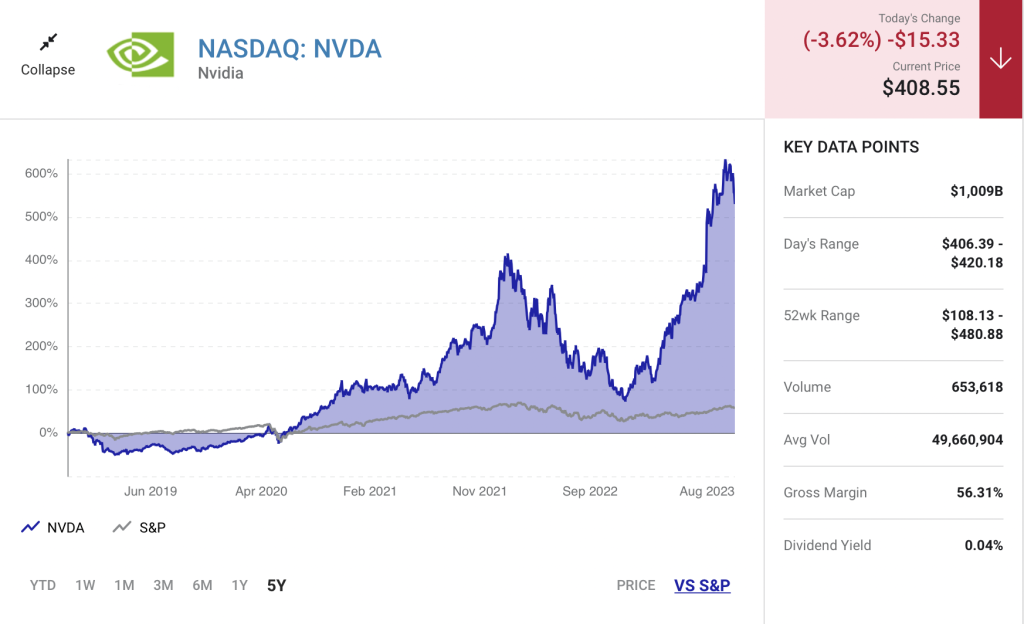

Nvidia‘s (NVDA -3.62%) current market cap is $1.05 trillion, but it seems destined to join the $2 trillion club, though the matter of timing is up for debate. The stock would need to increase by roughly 91% from Wednesday’s closing price to reach that watermark, which amounts to approximately 7% gains annually — easily within the realm of possibility.

One of the most significant headwinds for Nvidia is its recent run-up as the stock has gained 191% this year, driven by its connection to AI. However, the same fuel that pushed the stock higher this year could continue to pay dividends over the coming decade.

Nvidia has multiple market opportunities to fuel its climb. The company dominates the discrete desktop graphics processing unit (GPU) market, with an 84% market share. However, gamers have been keeping their graphics cards longer in the face of rampant inflation and falling discretionary income. As a result, sales of desktop GPUs have plunged to their lowest level in decades.

With inflation easing and an economic rebound on the horizon, however, Nvidia stands to benefit from pent-up demand as gamers replace their outdated chips.

The company is also a staple in data centers and cloud computing, which are other areas with significant growth opportunities. Nvidia recently revealed its fastest-data center processor yet. The Grace Hopper GH200 Superchip, set to debut next year, not only offers greater speed but is also more miserly in terms of power consumption. CEO Jensen Huang said that an operator running a $100 million data center could upgrade to the latest technology for just $8 million while realizing 20 times less power consumption.

Much of AI will reside in data centers and with cloud infrastructure providers, many of whom are already scrambling to upgrade their systems to meet the needs of generative AI. This mad dash to add additional computing horsepower is expected to continue for years, giving Nvidia the additional momentum it needs to join the $2 trillion club.

Read Next – $0.19 Penny Trade for 5,100%

Penny Trades” are cheap and explosive…

Warren Buffett grabbed 46 million of them for 1¢ a pop.

Right now, he’s up as much as a rare 4,429% on this trade.

But “Penny Trades” aren’t reserved for billionaires like Buffett.

Thanks to SEC loophole 30.52, you can play them in your brokerage account.

One of these “Penny Trades” shot up 183% in one day…

Penny Trades can pay far MORE than stocks…

Our readers just saw a 19¢ trade shoot up as much as a rare 5,100%…

Here’s the #1 “Penny Trade” for RIGHT NOW.