These downtrodden stocks are perfect buys with the Nasdaq in bear market territory.

It’s been a challenging year for the investing community. Since hitting their respective all-time highs in the first week of January, the widely followed S&P 500 and iconic Dow Jones Industrial Average have fallen by 14% and 10%, respectively, through this past weekend.

Things have been even worse for the growth-focused Nasdaq Composite, which is down 23% from its November closing high. With its decline of greater than 20%, the Nasdaq has entered a bear market.

Although the velocity of downside moves during bear markets can be scary and tug at investors’ heartstrings, history is pretty clear that these declines are the ideal time to put your money to work. After all, every major correction and bear market has eventually been wiped away by a bull market rally. In other words, buying innovative businesses during corrections and allowing your investment thesis to take shape over time is usually a moneymaking strategy.

The following three innovative stocks are down as much as 93% from their all-time highs, yet possess qualities that could allow these bear market buys to double your money over the next three years.

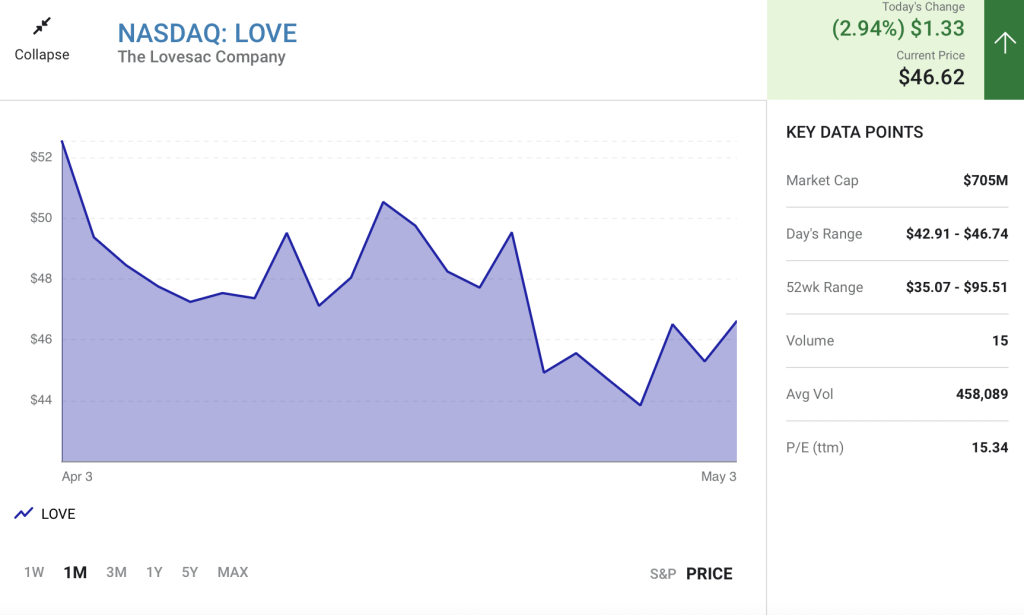

Lovesac: 54% below its all-time high

The first innovative company that has all the hallmarks of a screaming buy during this bear market decline in the Nasdaq Composite is furniture retailer Lovesac (LOVE 2.94%). Yes, I used the terms “innovative” and “furniture retailer” in the same sentence.

Generally, the furniture industry is a slow-growing, stodgy industry characterized by a reliance on foot traffic and a reasonably small number of furniture wholesalers. What Lovesac is doing is transforming this industry with its furniture, as well as its sales process.

Initially, Lovesac was best known for selling beanbag-styled chairs, which are known as “sacs.” But in fiscal 2022 (the company’s fiscal year ended Jan. 30, 2022), almost 88% of its revenue came from selling “sactionals.” A sactional is a modular couch that can be rearranged dozens of ways to fit virtually any living space.

Beyond function, the success of sactionals has been fueled by choice and their ecofriendly ties. Sactionals can be upgraded to include premium surround-sound speakers and charging ports, and offer more than 200 different cover choices for buyers. This all but ensures Lovesac’s key product will match the color or theme of a home. Perhaps best of all, the yarn used in sactionals is made entirely from recycled plastic water bottles. Considering how collectively passionate millennials are about protecting the environment, it shouldn’t be a surprise that millennials aged 35 to 39 are Lovesac’s core buyer.

Lovesac’s other differentiating factor is its omnichannel sales platform. Although the company does have 146 stores in 39 states, what’s truly impressive is that close to half of all sales during the height of the pandemic were originating online. By focusing on direct-to-consumer (DTC) sales, and complimenting DTC with pop-up showrooms and brand-name partnerships, Lovesac was able to drive its overhead expenses well below its peers.

With sustainable annual sales growth of 20% and a forward-year price-to-earnings ratio of just 10, Lovesac has a good shot at doubling investors’ money in three years (or less).

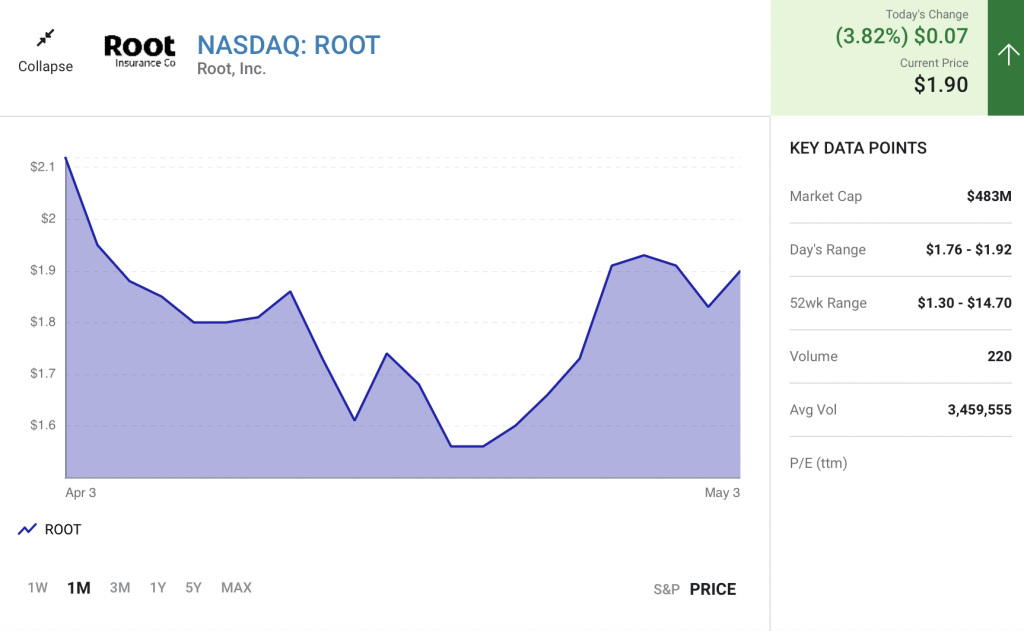

Root: 93% below its all-time high

Another innovative stock that’s been absolutely pulverized but has a chance to become a bear market hero for patient investors is tech-driven auto insurance company Root (ROOT 3.82%). Since its initial public offering in late October 2020, shares of the company are lower by a staggering 93%.

Similar to the furniture industry, the auto insurance industry is stodgy and boring, but often very profitable. It’s also a very impersonal industry. Auto insurance rates are typically determined by factors that include a person’s credit score or marital status — i.e., things that have nothing to do with how safe a driver is behind the wheel. Root wants to change that.

Instead of relying solely on decades’ old impersonal formulas to determine auto insurance rates, Root is leaning on telematics. In simple terms, it’s counting on highly sensitive instruments in smartphones, such as an accelerometer and gyroscope, to offer insight on how a person drives. For instance, high G-force readings would indicate someone who brakes hard, accelerates quickly, or potentially takes turns at a high rate of speed. By utilizing this data, Root believes it can offer drivers a more accurate price for the auto insurance policies it underwrites.

On the plus side, we’ve witnessed early success with this telematics-driven insurance model. With gross accident period loss ratios of below 100%, Root has shown that it is possible to underwrite profitable policies (before accounting for a myriad of other expenses). The company also noted in its first-quarter shareholder letter that 85% of its dynamic policy pricing is now fully automated.

On the other hand, Root is a start-up that’s been losing quite a bit of money as it tries to market itself and its brand to U.S. consumers. Also, the company’s gross accident period loss ratios have begun to creep back up as mitigation measures tied to the pandemic wind down and more drivers get back on the road.

While clearly a work-in-progress, the negativity surrounding Root appears overdone. If the company can continue to narrow its losses and deploy capital into its highest-margin policies, its shares could very easily double by 2025, if not sooner.

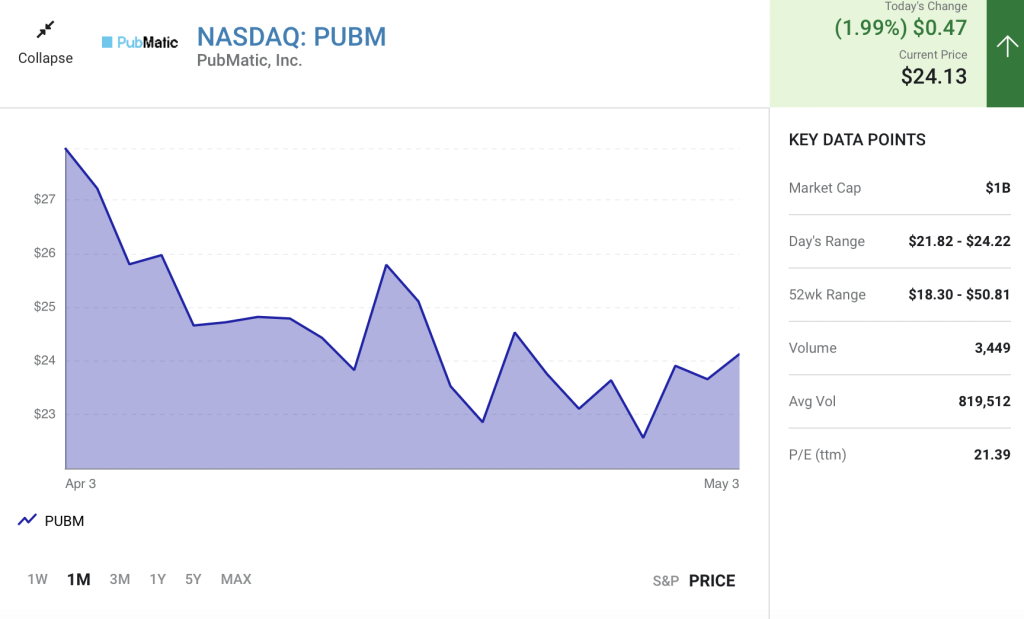

PubMatic: 66% below its all-time high

The third and final innovative stock that looks like a surefire bear market buy is cloud-based programmatic ad-tech company PubMatic (PUBM 1.99%). Shares of PubMatic have fallen by 66% since hitting their intra-day high 14 months ago.

The obvious concern for companies involved in advertising is that it’s a cyclical industry. Historically high inflation, coupled with aggressive Federal Reserve tightening, could induce a recession that leads merchants to pare back their ad spending.

But consider the other side to this scenario. Even though recessions are an inevitable part of the economic cycle, they generally don’t last longer than a few months or a couple of quarters. By comparison, periods of economic expansion usually last years. This means the ad industry is set for steady expansion over the long run.

What makes PubMatic so intriguing is the steady shift of ad dollars from print to digital formats. PubMatic is a sell-side provider that specializes in selling digital display space for publishing companies. Whereas digital ad spend is slated to grow by a little over 10% on an annual basis through the midpoint of the decade, PubMatic delivered 49% organic growth in 2021, and is forecast to grow sales by close to 25% in 2022 and 2023, according to Wall Street.

Something else noteworthy about this company is that it’s developed its own cloud infrastructure. Not having to rely on third parties allows PubMatic to recognize economies of scale as new publishers join the platform and existing clients spend a lot more. The end result should be higher gross margin than its peers.

At the moment, investors can scoop up shares of PubMatic for 26 times Wall Street’s forecast earnings for 2023. With a sustained growth rate of around 25%, this places the company at a price-to-earnings-growth ratio (PEG ratio) of about 1. A PEG ratio of 1 is undervalued for a tech stock, and all the more reason to expect PubMatic to double in value over the next three years.