No-brainer isn’t a term I use lightly, but these companies fit the bill.

A stock market correction is defined as a drop of 10% or more. As of this writing, the S&P 500 is down 17% from its high whereas the Nasdaq Composite index is down 27% from its previous high — technically trading in bear-market territory.

A 20%-plus drop happens every five to 10 years. It never feels good in the moment (you probably don’t need me to tell you that). But these setbacks have always proven to be opportune moments to pick up great bargains on long-term investments.

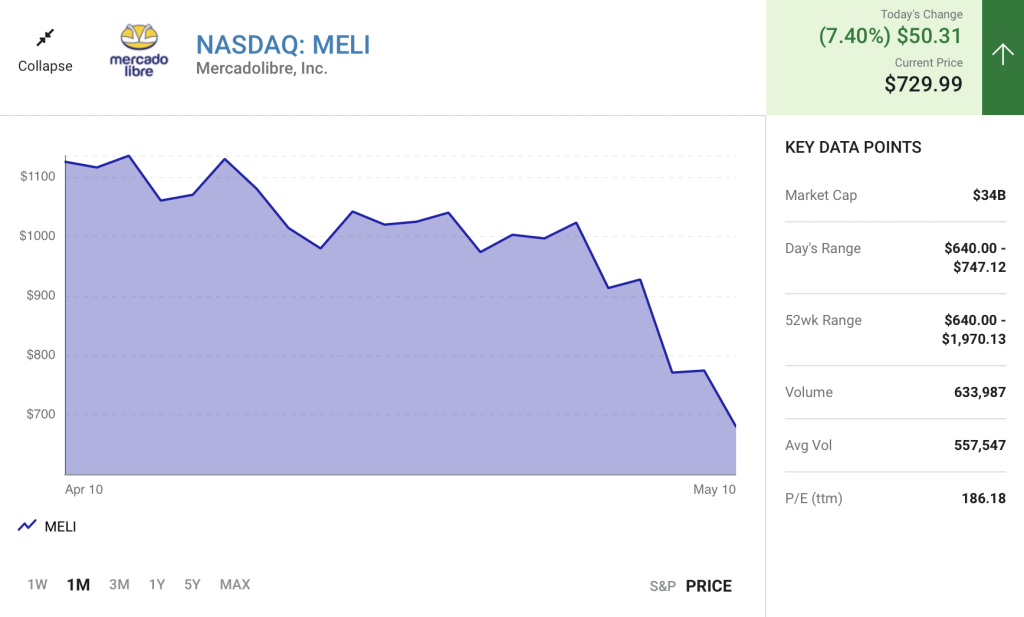

When the stock market is down around 20%, I get more aggressive in my buying. But I don’t just look for what’s down the most. I look for the best deals involving buy-and-hold opportunities. And shoemaker Crocs(CROX 7.91%), advertising-technology company PubMatic (PUBM 4.20%), financial-technology pioneer PayPal Holdings (PYPL -0.61%), and Latin American digital-commerce titan MercadoLibre (MELI 7.40%) are four of the biggest no-brainers I see right now.

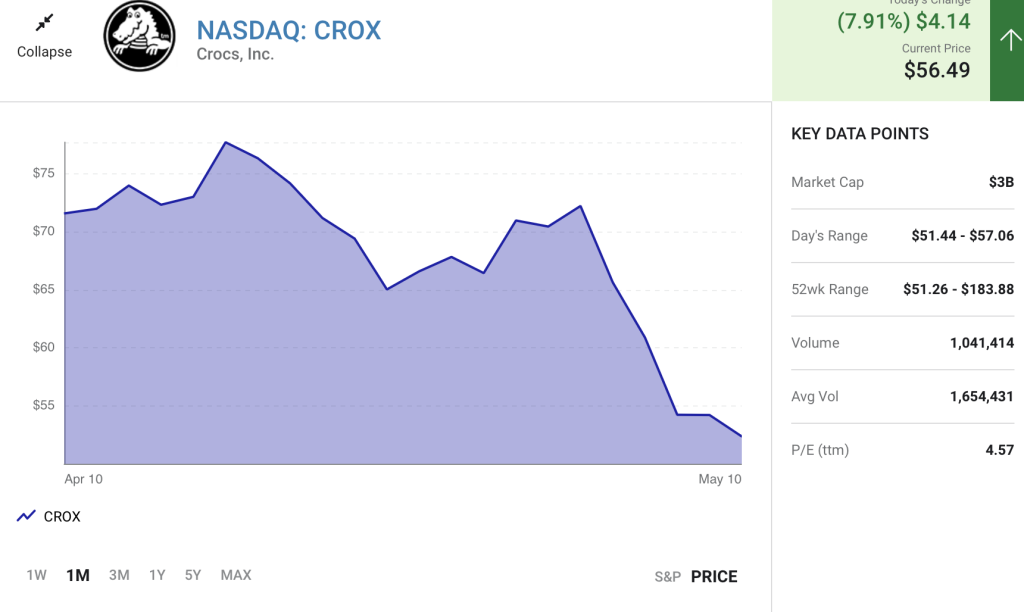

1. Crocs: The biggest no-brainer on the market

Crocs is the most recent stock I’ve purchased for my portfolio. I bought it because it’s the biggest no-brainer I see.

Revenue for the first quarter of 2022 for the Crocs brand was up 18.5% year over year to $542 million. However, the company recently acquired another company called Hey Dude, which it owned for part of the quarter and which added about $115 million in additional revenue.

Moreover, Crocs isn’t just generating shoe sales — it’s doing so with an enviable profit margin. The company has earned around $700 million in trailing-12-month net income. And it’s expecting at least $910 million in adjusted operating income this year.

Crocs stock has fallen 70% in recent months and now has a market capitalization of just $3.4 billion. In other words, Crocs is profitable, growing revenue at more than 50%, and trades at less than four times this year’s adjusted operating income. You’ll be hard-pressed to find a more compelling combination of growth and value than Crocs stock right now.

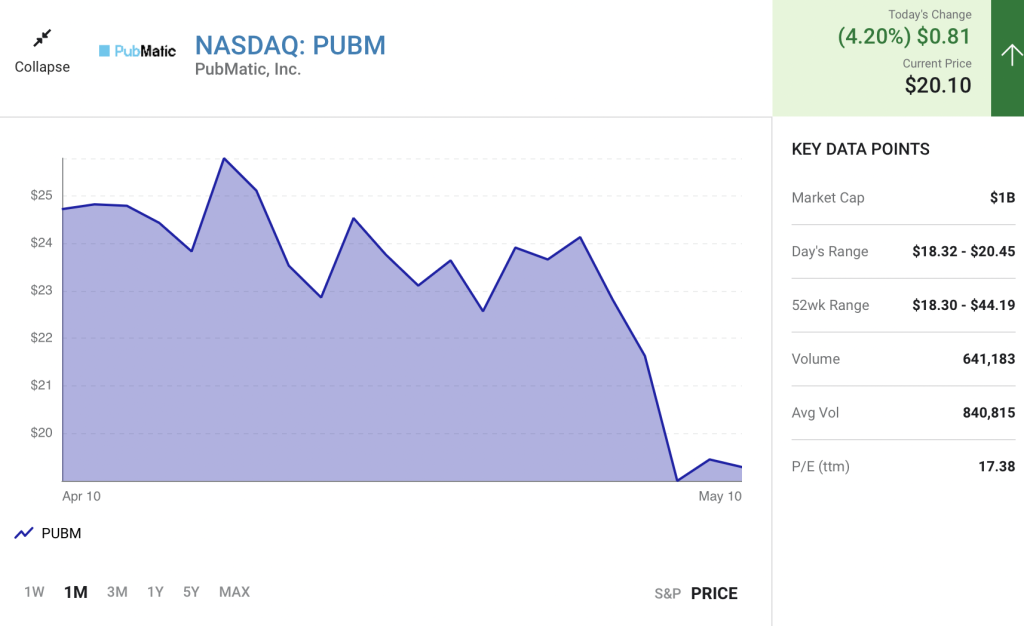

2. PubMatic: Cheaper than the average stock

PubMatic is a small advertising technology company that partners with publishers (mainly video) to sell their advertising slots. And it’s a good business to be in, considering it has a 23.7% net profit margin over the past 12 months. It’s generated $56.5 million in net income over the past 12 months, meaning the stock trades at just 19 times trailing earnings, which is cheaper than the stock market average, as the following chart shows.

PubMatic trades at a below-average valuation, but it has above-average prospects. While many companies are grappling with the highest rate of inflation in 40 years, PubMatic is seeing improvements in its cost structure over time. In the first quarter of 2020, it served up 31 trillion ad impressions at a cost of $1.21 per million. In the first quarter of 2022, it more than tripled its ad impressions, but its cost per million was down more than 50%.

In the coming years, I expect PubMatic will continue increasing the ads on its platform. Consider the powerful secular trend at work here. According to ResearchandMarkets.com, the global digital advertising and marketing market was $350 billion in 2020. By 2026, it’s expected to reach $786 billion.

PubMatic expects to grow its full-year revenue by around 25% in 2022 — faster than the industry growth rate Research and Markets is predicting. As mentioned, the company is profitable. And it has about $175 million in cash, cash equivalents, and marketable securities, and zero debt.

Investing legend Peter Lynch once quipped, “It is very hard to go bankrupt if you don’t have any debt.” PubMatic stock may be down over 70% from its all-time high. But it’s a growing, profitable business with no debt, meaning the company isn’t in any danger of going under.

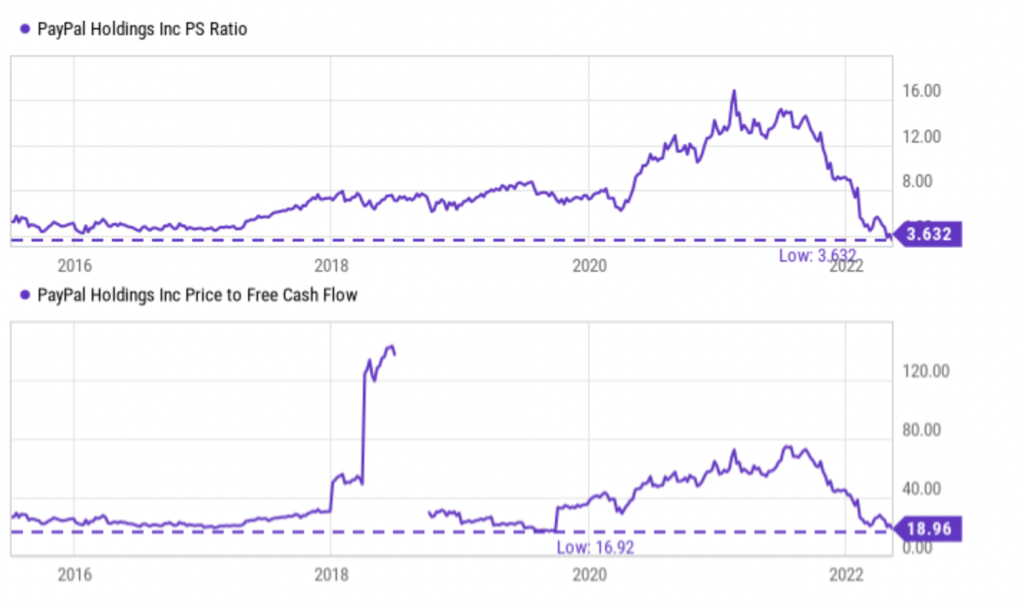

3. PayPal: If you missed the boat before, climb aboard now

PayPal went public in 2015 at around $37 per share. At the end of 2021, the stock was up over 400% during its 5-1/2 years as a stand-alone public company, utterly trouncing the 130% return of the S&P 500. No doubt some investors felt like they missed the boat.

However, PayPal stock is now down 60% year to date and is barely ahead of the market average over its life. So if you felt like you missed the boat before, climb aboard. The price per share is lower now than it was in March 2020 when the market crashed due to the start of the pandemic.

To me, what’s most stunning about PayPal’s decline is its current valuation. It trades at one of the cheapest price-to-free-cash-flow valuations it’s ever traded at. And from a price-to-sales (P/S) perspective, it’s never been cheaper, as the chart below shows.

To be fair, PayPal is struggling somewhat right now. It has 429 million active accounts and that scale means it’s hard to gain incremental users — new accounts in the first quarter of 2022 were only up 1% from the previous quarter. Because of this, management only expects total payment volume to grow 13% to 15% in 2022 compared to 2021 — historically slow for this company.

That said, PayPal still generates over $1 billion in quarterly free cash flow — money that management can use to acquire other companies or reward shareholders. For example, it bought back 11 million shares in Q1 alone — about 1% of total shares. But with the depressed price currently, management could opportunistically buy back shares.

4. MercadoLibre: For investors looking for competitive advantages

Finally, you don’t need to overthink buying MercadoLibre stock at its current price. The future reward far outweighs the price the market is asking investors to pay. It’s down 60% from its all-time high as of this writing. But while that drop is huge, this is still a market-beating stock — up over 2,600% since going public about 15 years ago.

If you wanted to buy MercadoLibre stock at a P/S valuation of under five, there are only two times in history that you could have bought it — during the Great Recession and right now. That’s right, MercadoLibre stock hasn’t been this cheap in over a decade.

When companies struggle, they fairly trade at depressed valuations. But recent quarterly financial results for MercadoLibre don’t depict a dying business. To the contrary, revenue for the first quarter of 2022 was up 63% year over year, active accounts were up 15%, and gross merchandise volume when adjusted for currency fluctuations (the value of items sold on its marketplace) was up almost 32%.

However, the crown jewel of MercadoLibre’s first-quarter report was its fintech arm, Mercado Pago. Total payment volume on Mercado Pago was up 81% year over year, surpassing $25 billion. Importantly, 68% of this payment volume occurred off of MercoLibre’s own e-commerce portal. This means Mercado Pago is gaining broad adoption, regardless of the future adoption of MercadoLibre’s marketplace.

Market corrections spark fear in investors. Because of this, I can understand if you aren’t just looking for a good deal. You likely want a company with a durable competitive advantage as well — a moat. MercadoLibre has this as well, in my opinion, with Mercado Envios.

Mercado Envios is MercadoLibre’s shipping-logistics network. In the Latin American markets where it does business, shipping has historically been tough. However, through years of building its infrastructure, MercadoLibre is in a position of profound strength. It’s been a costly venture. But as of Q1, 79% of its merchandise volume can be delivered in 48 hours or less. I don’t believe any competitor can match this service at this scale. Therefore, for people who want their stuff fast (and who doesn’t?), MercadoLibre is well-positioned for the future.

The final caveat

When I say Crocs, PubMatic, PayPal, and MercadoLibre are no-brainer buys, I’m not saying that these stocks can’t fall more than they already have — they indeed can. If you’re looking for guaranteed positive returns in the next year or two, the stock market isn’t the place to find it.

I’m calling these four stocks no-brainer buys because of their strong potential to create shareholder value from here. Creating value is a time-intensive process. It could be three, four, or five years before shareholders recognize market-beating returns. But for those willing to demonstrate this level of patience, I believe these four stocks offer exceptional value right now.