Buying this chipmaker allows you to get in on a handful of different, exciting industries.

If you’re looking for a hedge against market volatility, diversification is a great way to go. Holding 25 stocks or more is one way to protect your portfolio from drastic swings in a single stock or industry. But some businesses can provide different types of diversification within their own company. Starbucks, for example, has revenue from China, creating geographic diversification for investors.

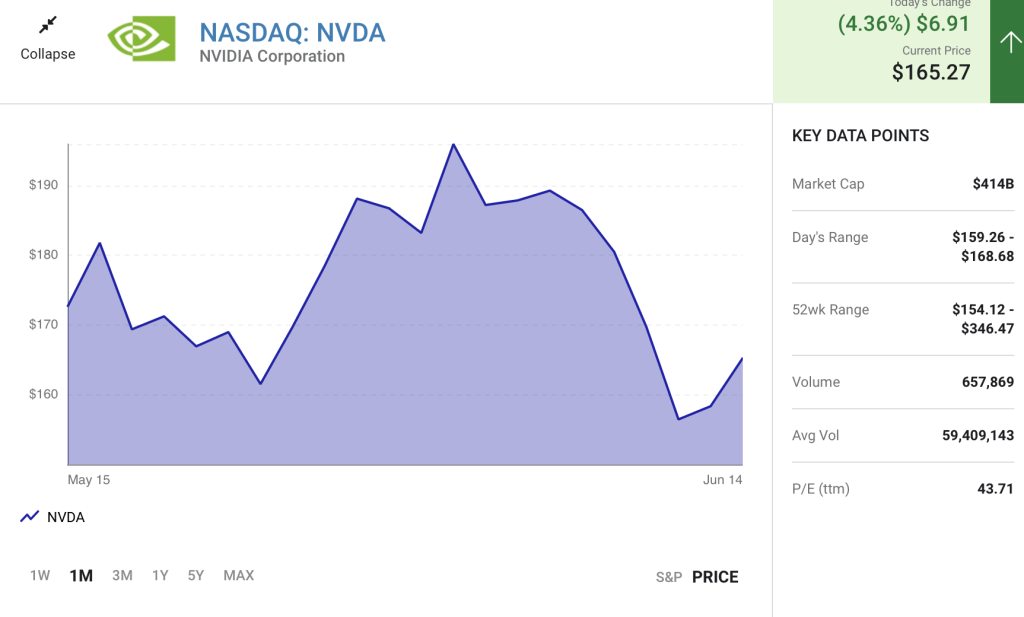

In a hypothetical situation where I could only buy one stock, I would look for one with impressive internal diversification, such as Nvidia (NVDA 4.36%). The company has operations in multiple markets that are growing fast and could each be huge over the long term.

Getting into lucrative industries

Nvidia is primarily known for its gaming graphics processing units (GPUs). In the first quarter (ended May 1), gaming GPUs made up almost 44% of the $8.3 billion in revenue Nvidia generated across all its business units. But the company operates in other industries as well, and has seen tremendous success in these markets, namely in data centers. First quarter revenue in this segment soared 83% year over year, reaching $3.75 billion and taking the spot as Nvidia’s biggest revenue driver in Q1.

The chipmaker’s core business products are considered to be the gold standard in their respective industries. Nvidia is a top dog in the gaming industry, holding roughly 83% market share in the discrete GPU space as of Q3 2021, according to Jon Peddie Research. Within data centers, the company has 67% of the top supercomputers using its products. Nvidia’s professional visualization unit already boasts over 90% market share in graphics for workstations.

But Nvidia’s optionality expands beyond these key segments. The company provides chips for artificial intelligence (AI), omniverse, and autonomous vehicle industries. These industries create a total addressable market worth $600 billion combined for Nvidia in the future.

Nvidia has also attracted big dogs as customers, and these partnerships could allow the chipmaker to further capitalize on the massive potential ahead. For example, in 2022, Nvidia landed Lucid Group, BYD, and Tata Motors‘ Jaguar Land Rover as customers for the Nvidia Drive solution, which is a suite of products covering everything from autonomous vehicle hardware to software and simulation tools to gather vehicle data. These partnerships are enduring and highly sticky, so Nvidia’s success in the early stages of this space could allow for long-term leadership.

Nvidia has the profits to withstand the competition

Many of Nvidia’s endeavors which I find so appealing are still in their infancy, meaning there are plenty of opportunities for Nvidia to see continued expansion over the long term. Take artificial intelligence (AI) software, for example. Nvidia doesn’t yet break out revenue for that venture but estimates that it could become a $150 billion business, with a total market worth $1 trillion ahead of it.

The risk, of course, is that the company might not be able to capitalize on these potential markets. Competition is fierce, and there’s no guarantee that Nvidia will conquer all of the industries it’s currently targeting. However, Nvidia isn’t playing a winner-take-all game. These segments are so large that there can be multiple winners, leaving room for both Nvidia and its competitors.

To remain a major player, Nvidia will have to invest heavily in research and development and maintain its high-quality products. Luckily, the company is gushing cash. In Q1 alone, the company generated over $1.35 billion in free cash flow (FCF) and $1.6 billion in net income.

Why I love Nvidia for the long haul

At 50.5 times free cash flow, Nvidia shares are not cheap — especially compared to other chipmakers like Advanced Micro Devices (AMD 2.65%) and Intel (INTC 1.90%), which trade at 33 times and 16 times FCF, respectively. But again, the chipmaking field is not a winner-take-all game, meaning that all three companies could live up to their respective valuations. Nvidia is undoubtedly trading at a premium today, but it is justifiable given its opportunity.

Despite its high valuation, all signs point to Nvidia being a quality investment. It’s quickly diversifying across industries that have immense potential, and that variety helps the company to better weather the market’s cyclical demand for chips. While there is substantial execution risk, I think that Nvidia’s leadership across core and emerging industries gives the company a cushion for stability and a blueprint for future success. As long as the company sees continued growth across the board, especially in its emerging segments, Nvidia would be my top choice if I could only buy one stock.