Investors in the stock market love a good acronym. After all, “FAANG,” coined by business news personality Jim Cramer, has been used for years to describe some of the greatest technology stocks in the U.S.

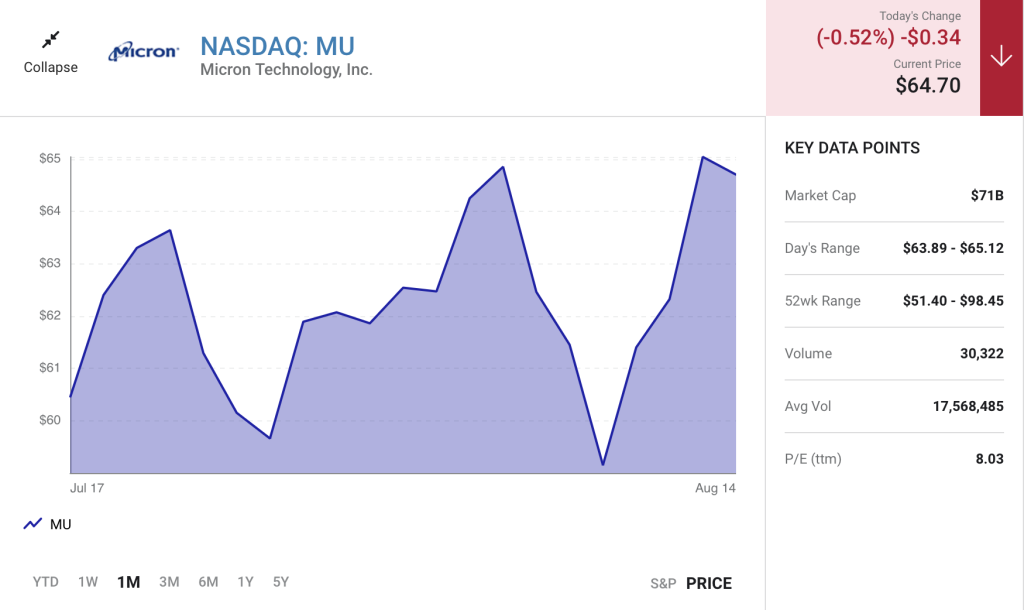

I’m going to introduce you to the “MAN” stocks: Micron Technology (MU -0.52%), Advanced Micro Devices(AMD 0.18%), and Nvidia (NVDA 1.73%).

They’re three of the largest producers of advanced computer chips (semiconductors) in the world. Their industry is constantly growing in importance, as more products and services rely on digital capabilities to serve consumers and businesses. Here’s why investors should consider buying these MAN stocks now and holding them for the long run.

1. Micron Technology: A leader in memory and storage chips

The memory (DRAM) and data storage (NAND) chip businesses aren’t nearly as flashy or exciting as graphics or processing, but they play an important role in some of consumers’ most prized electronics. Micron is a global leader in the space, and there are some emerging opportunities that could supercharge the company’s growth.

At the moment, use cases like personal computing and the data center make up the majority of Micron’s revenue, and the company continues to drive innovation. In fact, it just released the world’s fastest graphics memory solution in partnership with Nvidia, which will be used in that company’s next-generation GeForce RTX graphics chips.

But Micron’s smaller segments might hold the most promise in the long run. In the fiscal third quarter of 2022 (ended June 2), the company’s automotive revenue hit an all-time high, and it anticipates a further surge in demand thanks to 100 new electric vehicle (EV) models being launched worldwide in 2022. Micron describes EVs as data centers on wheels, and that means they will require more memory and storage capacity than ever before.

The company is also benefiting from the transition to the 5G network, with 5G-enabled mobile devices expected to hit 50% penetration of the total addressable market this year. Compared to their 4G-enabled predecessors, these devices require 50% more memory and double the storage.

By the close of fiscal 2022 (Sept. 2), Micron expects it will have generated $31.3 billion in sales and $7.90 in earnings per share. Analysts predict a drop in both metrics during fiscal 2023 under tighter economic conditions. But for the best returns, investors should certainly view Micron through a 10-year lens.

2. Advanced Micro Devices: Powering the most popular products and services

If there were rock stars in the semiconductor industry, Advanced Micro Devices would be one of them. It makes some of the most sought-after chips for personal computing, gaming, and the data center, and the list of use cases is only growing longer — thanks in part to the company’s recent $49 billion acquisition of Xilinx, the world leader in adaptive computing.

AMD’s chips are responsible for powering products and services for consumers and businesses alike, giving the company diverse exposure to the broader economy. It serves the world’s largest providers of cloud services in its data center segment, including the industry’s top two giants Amazon (AMZN -0.26%) and Microsoft (MSFT 0.53%). At Microsoft, AMD chips can also be found in the Surface line of notebook computers and tablet devices, plus the Xbox gaming console.

AMD thinks that the next frontier over the coming decade (and beyond) is adaptive computing, a technology that allows chips to adjust to the user’s requirements in real time, without having to swap out hardware. It will be critical for complex computing applications that involve artificial intelligence (AI). And Xilinx has previously indicated that it can deliver performance that’s four times faster than the best graphics processors on the market.

Xilinx could supercharge AMD’s already red-hot business. The combined companies are expecting to deliver $26.3 billion in revenue for the whole of 2022, a jump of nearly 60% compared to AMD’s 2021 result. Plus, analysts expect the company will grow both sales and profitability in 2023. But looked at over the long run, AMD might just be getting warmed up.

3. Nvidia: From hardware to platform computing

The third and last chipmaker in the MAN acronym is Nvidia, a company that is often regarded as a pioneer in artificial intelligence, and is still leading the way today. It’s bridging the gap between innovative hardware products and its aspirations to become a platform computing company, if it’s not there already.

The company applies AI and machine learning in multiple ways. One of its smaller segments is automotive and robotics, which hosts Nvidia Drive, an end-to-end solution for car manufacturers that want to implement autonomous self-driving technology. Nvidia has already built a sales pipeline of $11 billion from 35 top carmakers, and in 2024, Mercedes-Benz Group will roll out its first Nvidia-driven cars under this program. By 2030, the opportunity in autonomous vehicles could exceed $2.1 trillion annually.

Nvidia has also built a revolutionary 3D rendering platform called Omniverse, which companies like Amazon are using to create lifelike digital replicas of important assets with to-the-millimeter accuracy. As an example, Omniverse allows Amazon to make changes to its fulfillment centers in the virtual sphere before committing time and money to adjusting the real-life versions.

Still, those are segments of the future, and right now gaming and the data center make up 88% of Nvidia’s sales. The company will report its financial results for the second quarter of fiscal 2023 on Aug. 24; it expects short-term weakness, but for the full year, analysts still anticipate 15% sales growth to $31 billion.

In the long run, demand for technologies driven by AI will only grow, which could result in Nvidia’s smaller segments overtaking its larger ones in sales. By one estimate, AI could add $13 trillion to the global economy by 2030, offering a hint at Nvidia’s long-term potential.

Read Next: : The One-Ticker Retirement Plan –“Over the Shoulder” Demo Now Available

Market Wizard Larry Benedict crushed the market in 2022.

But he hasn’t done it with a “traditional” method…

For a limited time, he’s sharing a free over-the-shoulder “demo” of his strategy in action.

It’s less than 10 seconds –watch it here.