Energy prices are still high, but these midstream stocks have basically stalled, resulting in very high yields.

In 2022 ExxonMobil (XOM -1.29%) reported adjusted earnings per share of $14.06, more than double the $5.38 in earned in 2021. It’s fair to say that the energy sector has recovered since the deep downturn in 2020, when ExxonMobil’s earnings dipped into the red.

If you are looking for a cheap energy stock, however, ExxonMobil probably isn’t a good choice. However, midstream giants Enterprise Products Partners (EPD -0.42%) and Enbridge (ENB -0.73%) might be. Here’s why.

What a rally

Given ExxonMobil’s strong earnings upturn, it probably won’t surprise you to find that the stock price has jumped nearly 60% since the start of 2020, before the pandemic. From its low point in mid-March 2020, the stock is up over 200%. If you were hoping to benefit from the energy rebound, you have probably missed the best part of the ride with ExxonMobil. But Enterprise’s and Enbridge’s stock prices are still just slightly below where they were at the start of 2020, off by around 6% and 2%, respectively.

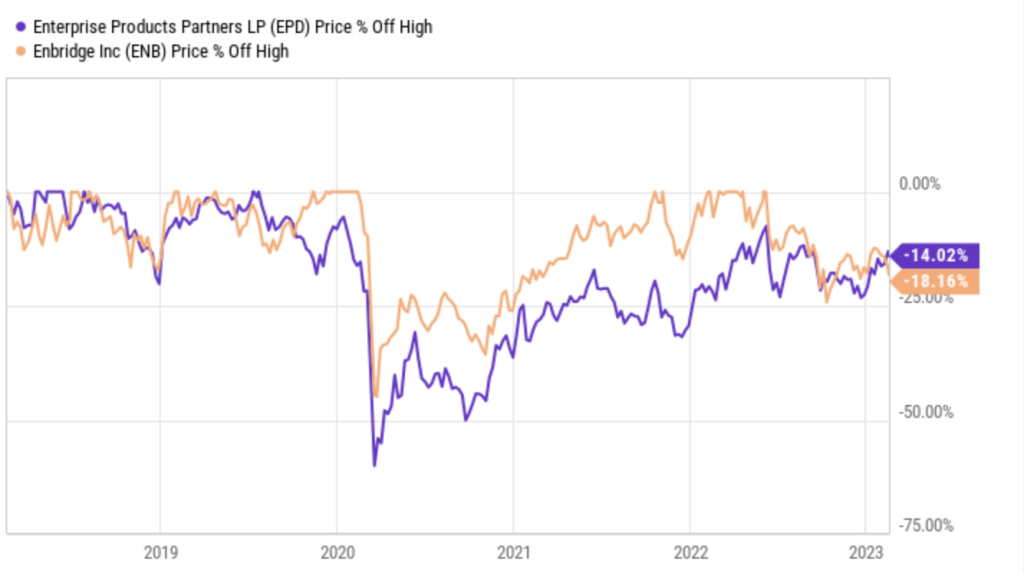

To be fair, relative to the bottom of 2020’s bear market, both are up strongly. Enbridge has rebounded around 42% since the nadir, and Enterprise is higher by 93%. And yet they still haven’t fully recovered from the big dips they experienced. If you are looking for high-yield investment opportunities in the energy sector, these two midstream giants still look fairly attractive. In fact, if you extend the look back to five years, Enterprise is still 14% off its high-water mark, and Enbridge is lower by 18%. That makes them appear even more attractive.

Getting paid well

The real stars here, however, are the yields on offer from Enterprise and Enbridge. To provide some reference points, an S&P 500 index fund yields around 1.6% today. ExxonMobil’s yield is around 3.2%. Enbridge’s dividend yield is 6.8% and Enterprise’s distribution yield is 7.4%. Don’t get too worried about the high yields, either. Enbridge estimates that its distributable cash flow payout ratio is smack in the middle of its 60%-to-70% target. Enterprise, meanwhile, estimates that its distributable cash flow covered its payments by 1.9 times in 2022. In addition, both Enterprise and Enbridge have investment-grade-rated balance sheets.

These are rock-solid midstream players with really strong histories. That is probably best summed up by their respective annual disbursement histories. Enbridge has increased its dividend annually for 28 years. Master limited partnership (MLP) Enterprise has increased its distribution annually for 24 years. Given the strong financial positions of both today, there’s no particular reason to think the huge yields on offer are at risk.

That said, neither Enbridge nor Enterprise should be looked at as a growth investment. After a decade or more of aggressive expansion in the midstream sector, most of the best opportunities are gone. Growth from here is likely to be relatively modest at best. However, given the integral nature of the assets these two own and their fee-driven structures, the foundation for slow and steady growth is very strong. And that’s what should interest conservative investors focused on income.

One key difference here, however, is that Enterprise is heavily focused on carbon fuels. Enbridge, meanwhile, is starting to dip its toes into the clean energy space. Its clean energy division makes up just 3% or so of earnings before interest, taxes, depreciation, and amortization (EBITDA), but it has a number of large projects on the horizon that should move that number higher. Essentially Enterprise is for those looking to focus on the energy sector, while Enbridge offers a bit of a hedge as the world gets more green.

Still an opportunity

Enbridge and Enterprise are income stocks and most of your returns will come from their high yields. However, given the vital nature of the assets they own and the fact that investors are still down on this niche of the energy sector, dividend investors might still find each of interest even as many of the drillers have rallied well above their pre-pandemic levels.

Read next – Secret NASA project will destroy Elon Musk

Between 1956 and 1958, NASA and the United States Air Force conducted a series of covert tests in an isolated compound in rural Virginia.

Access to this special program was classified higher than “Top Secret”…

And only 25 people knew of the project’s existence.

Its codename was Project Suntan.

Its mission?

To develop an entirely new type of fuel that would allow the U.S. to achieve total energy dominance over the Soviet Union.

The elite team of physicists and engineers were given a blank check by the government and told to do “whatever it takes.”

After two years and $2 billion…

The members of Project Suntan stumbled on a MASSIVE discovery.

A way to convert one of the Earth’s most abundant resources into cheap, powerful, virtually endless energy.

Following their discovery, the team was quietly disbanded.

And this new fuel was kept secret by the highest levels of U.S. intelligence.

But all that is changing as we speak.

Finally, after more than 60 years in secrecy, this fuel is slowly being rolled out to the public.

And one tiny company has obtained the patents on this world-changing “Future Fuel.”

Forget Tesla, or any of the other “alternative energy” companies out there.

Once this “Future Fuel” hits mainstream, it will make electric power obsolete.

It will make wind and solar obsolete.

It will even make oil obsolete.

And it will hand investors a once-in-a-lifetime chance to get rich.

Imagine if you had been able to invest in the birth of the oil economy.

You would have had more wealth than you could ever imagine.

Well, you have a rare second chance.

Because as “Future Fuel” replaces oil, wind, solar, and electric…

Investors could turn every $500 into $234,000 or more.

The future is here.